|

|

|

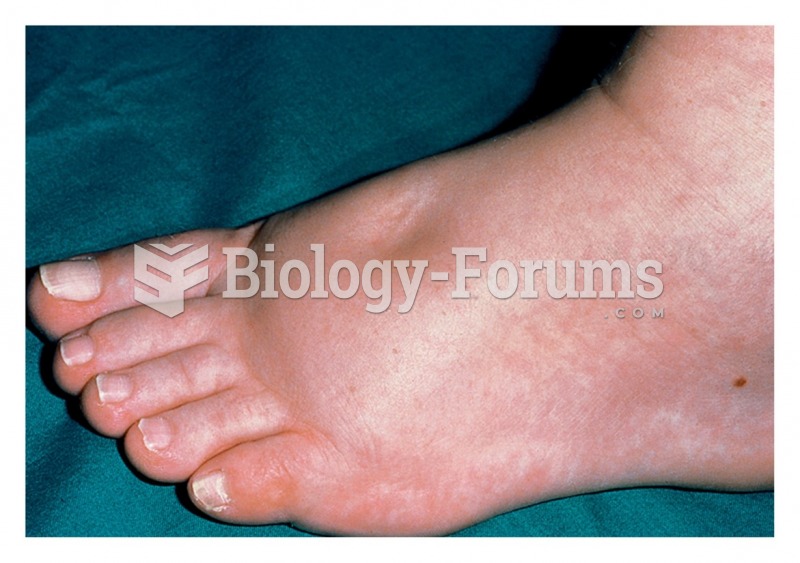

Hip fractures are the most serious consequences of osteoporosis. The incidence of hip fractures increases with each decade among patients in their 60s to patients in their 90s for both women and men of all populations. Men and women older than 80 years of age show the highest incidence of hip fractures.

The Babylonians wrote numbers in a system that used 60 as the base value rather than the number 10. They did not have a symbol for "zero."

The eye muscles are the most active muscles in the whole body. The external muscles that move the eyes are the strongest muscles in the human body for the job they have to do. They are 100 times more powerful than they need to be.

On average, the stomach produces 2 L of hydrochloric acid per day.

Chronic necrotizing aspergillosis has a slowly progressive process that, unlike invasive aspergillosis, does not spread to other organ systems or the blood vessels. It most often affects middle-aged and elderly individuals, spreading to surrounding tissue in the lungs. The disease often does not respond to conventionally successful treatments, and requires individualized therapies in order to keep it from becoming life-threatening.