|

|

|

Never take aspirin without food because it is likely to irritate your stomach. Never give aspirin to children under age 12. Overdoses of aspirin have the potential to cause deafness.

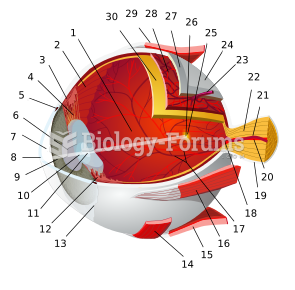

A cataract is a clouding of the eyes' natural lens. As we age, some clouding of the lens may occur. The first sign of a cataract is usually blurry vision. Although glasses and other visual aids may at first help a person with cataracts, surgery may become inevitable. Cataract surgery is very successful in restoring vision, and it is the most frequently performed surgery in the United States.

Though Candida and Aspergillus species are the most common fungal pathogens causing invasive fungal disease in the immunocompromised, infections due to previously uncommon hyaline and dematiaceous filamentous fungi are occurring more often today. Rare fungal infections, once accurately diagnosed, may require surgical debridement, immunotherapy, and newer antifungals used singly or in combination with older antifungals, on a case-by-case basis.

Once thought to have neurofibromatosis, Joseph Merrick (also known as "the elephant man") is now, in retrospect, thought by clinical experts to have had Proteus syndrome. This endocrine disease causes continued and abnormal growth of the bones, muscles, skin, and so on and can become completely debilitating with severe deformities occurring anywhere on the body.

About 80% of major fungal systemic infections are due to Candida albicans. Another form, Candida peritonitis, occurs most often in postoperative patients. A rare disease, Candida meningitis, may follow leukemia, kidney transplant, other immunosuppressed factors, or when suffering from Candida septicemia.