|

|

|

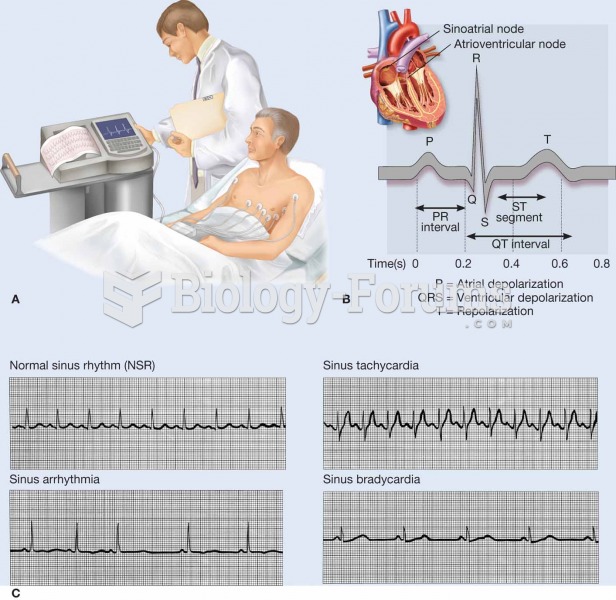

Persons who overdose with cardiac glycosides have a better chance of overall survival if they can survive the first 24 hours after the overdose.

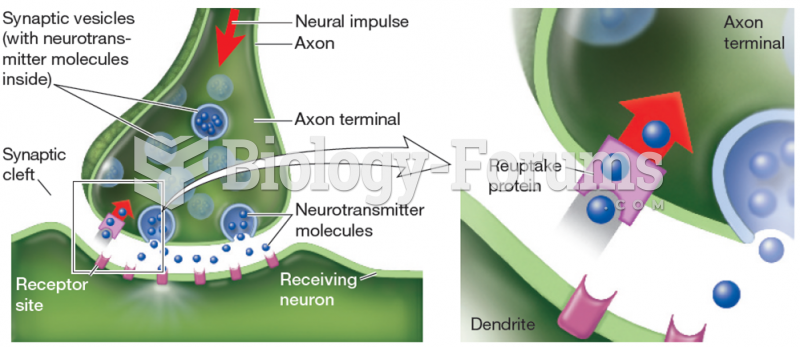

Chronic marijuana use can damage the white blood cells and reduce the immune system's ability to respond to disease by as much as 40%. Without a strong immune system, the body is vulnerable to all kinds of degenerative and infectious diseases.

Pope Sylvester II tried to introduce Arabic numbers into Europe between the years 999 and 1003, but their use did not catch on for a few more centuries, and Roman numerals continued to be the primary number system.

Long-term mental and physical effects from substance abuse include: paranoia, psychosis, immune deficiencies, and organ damage.

In 2012, nearly 24 milliion Americans, aged 12 and older, had abused an illicit drug, according to the National Institute on Drug Abuse (NIDA).