Answer to Question 1

E

Answer to Question 2

1. Key inputs for income statement computations are:

January February March

Beginning inventory

Production

Goods available for sale

Units sold

Ending inventory 0

1,400

1,400

1,300

100 100

1,375

1,475

1,375

100 100

1,430

1,530

1,455

75

The budgeted fixed manufacturing cost per unit and budgeted total manufacturing cost per unit under absorption costing are:

January February March

(a) Budgeted fixed manufacturing costs

(b) Budgeted production

(c) = (a) (b) Budgeted fixed manufacturing cost per unit

(d) Budgeted variable manufacturing cost per unit

(e) = (c) + (d) Budgeted total manufacturing cost per unit 490,000

1,400

350

950

1,300 490,000

1,400

350

950

1,300 490,000

1,400

350

950

1,300

(a) Variable Costing

January 2014 February 2014 March 2014

Revenuesa 4,550,000 4,812,500 5,092,500

Variable costs

Beginning inventoryb

0 95,000

95,000

Variable manufacturing costsc 1,330,000 1,306,250 1,358,500

Cost of goods available for sale

Deduct ending inventoryd 1,330,000

(95,000) 1,401,250

(95,000) 1,453,500

(71,250)

Variable cost of goods sold

Variable operating costse

Total variable costs 1,235,000

942,500

2,177,500 1,306,250

996,875

2,303,125 1,382,250

1,054,875

2,437,125

Contribution margin

Fixed costs

Fixed manufacturing costs

Fixed operating costs

Total fixed costs

Operating income

490,000

120,000

2,372,500

610,000

1,762,500

490,000

120,000

2,509,375

610,000

1,899,375

490,000

120,000

2,655,375

610,000

2,045,375

a 3,500 1,300; 3,500 1,375; 3,500 1,455

b ? 0; 950 100; 950 100

c 950 1,400; 950 1,375; 950 1,430

d 950 100; 950 100; 950 75

e 725 1,300; 725 1,375; 725 1,455

(b) Absorption Costing

January 2014 February 2014 March 2014

Revenuesa

Cost of goods sold

Beginning inventoryb

0 4,550,000

130,000 4,812,500

130,000 5,092,500

Variable manufacturing costsc 1,330,000 1,306,250 1,358,500

Allocated fixed manufacturing costsd 490,000 481,250 500,500

Cost of goods available for sale 1,820,000 1,917,500 1,989,000

Deduct ending inventorye (130,000) (130,000) (97,500)

Adjustment for prod. vol. var.f 0 8,750 U (10,500) F

Cost of goods sold 1,690,000 1,796,250 1,881,000

Gross margin 2,860,000 3,016,250 3,211,500

Operating costs

Variable operating costsg 942,500 996,875 1,054,875

Fixed operating costs 120,000 120,000 120,000

Total operating costs 1,062,500 1,116,875 1,174,875

Operating income 1,797,500 1,899,375 2,036,625

a 3,500 1,300; 3,500 1,375; 3,500 1,455

b ? 0; 1,300 100; 1,300 100

c 950 1,400; 950 1,375; 950 1,430

d 350 1,400; 350 1,375; 350 1,430

e 1,300 100; 1,300 100; 1,300 75

f 490,000 490,000; 490,000 481,250; 490,000 500,500

g 725 1,300; 725 1,375; 725 1,455

2. Absorption-costingoperating income Variable costingoperating income = Fixed manufacturingcosts inending inventory Fixed manufacturingcosts inbeginning inventory

January: 1,797,500 1,762,500 = (350 100) 0

35,000 = 35,000

February: 1,899,375 1,899,375 = (350 100) (350 100)

0 = 0

March: 2,036,625 2,045,375 = (350 75) (350 100)

8,750 = 8,750

The difference between absorption and variable costing is due solely to moving fixed manufacturing costs into inventories as inventories increase (as in January) and out of inventories as they decrease (as in March).

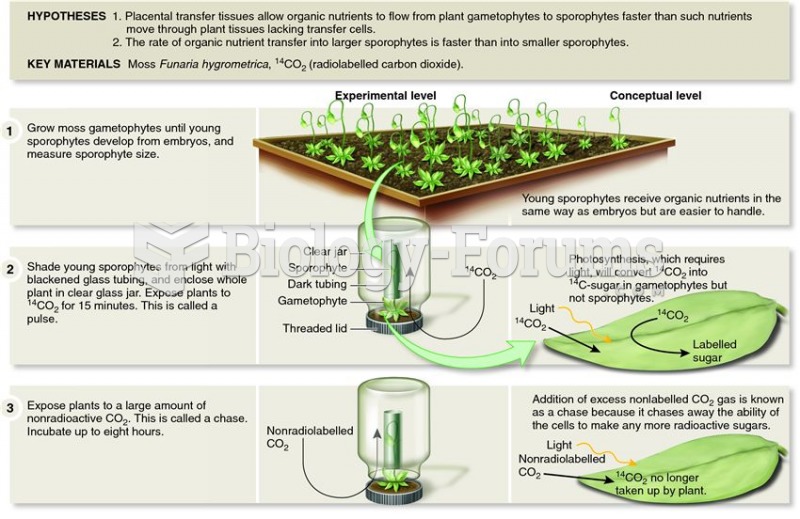

Browning and Gunning demonstrated that placental transfer tissues increase plant reproductive succes

Browning and Gunning demonstrated that placental transfer tissues increase plant reproductive succes

The recent mass upheavals in Tunisia, Egypt, Libya, Yemen, and Syria gave political scientists a cha

The recent mass upheavals in Tunisia, Egypt, Libya, Yemen, and Syria gave political scientists a cha