|

|

|

All adverse reactions are commonly charted in red ink in the patient's record and usually are noted on the front of the chart. Failure to follow correct documentation procedures may result in malpractice lawsuits.

Nearly all drugs pass into human breast milk. How often a drug is taken influences the amount of drug that will pass into the milk. Medications taken 30 to 60 minutes before breastfeeding are likely to be at peak blood levels when the baby is nursing.

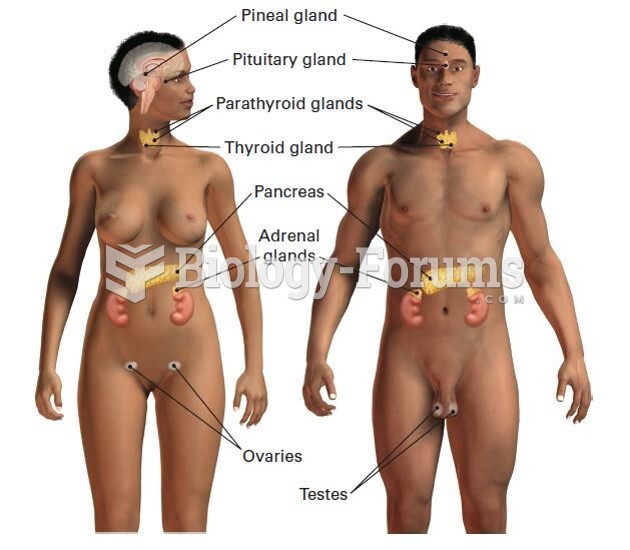

Egg cells are about the size of a grain of sand. They are formed inside of a female's ovaries before she is even born.

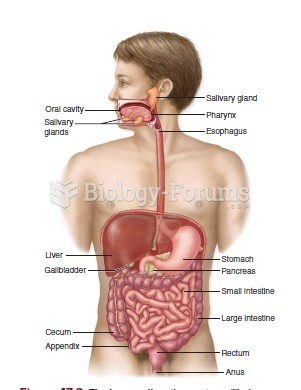

Many people have small pouches in their colons that bulge outward through weak spots. Each pouch is called a diverticulum. About 10% of Americans older than age 40 years have diverticulosis, which, when the pouches become infected or inflamed, is called diverticulitis. The main cause of diverticular disease is a low-fiber diet.

The eye muscles are the most active muscles in the whole body. The external muscles that move the eyes are the strongest muscles in the human body for the job they have to do. They are 100 times more powerful than they need to be.