|

|

|

Women are two-thirds more likely than men to develop irritable bowel syndrome. This may be attributable to hormonal changes related to their menstrual cycles.

Though newer “smart” infusion pumps are increasingly becoming more sophisticated, they cannot prevent all programming and administration errors. Health care professionals that use smart infusion pumps must still practice the rights of medication administration and have other professionals double-check all high-risk infusions.

As many as 28% of hospitalized patients requiring mechanical ventilators to help them breathe (for more than 48 hours) will develop ventilator-associated pneumonia. Current therapy involves intravenous antibiotics, but new antibiotics that can be inhaled (and more directly treat the infection) are being developed.

More than one-third of adult Americans are obese. Diseases that kill the largest number of people annually, such as heart disease, cancer, diabetes, stroke, and hypertension, can be attributed to diet.

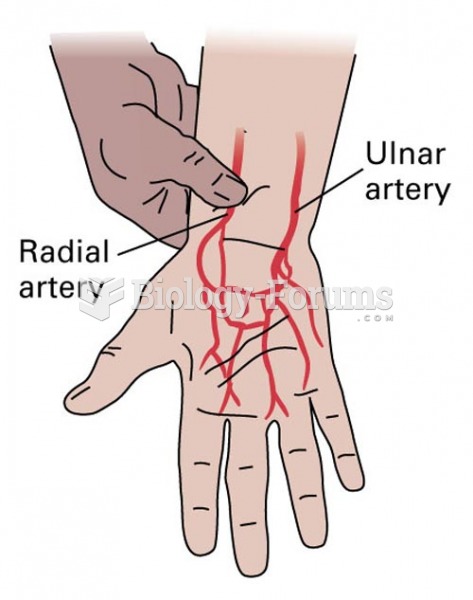

There are 60,000 miles of blood vessels in every adult human.