|

|

|

Hyperthyroidism leads to an increased rate of metabolism and affects about 1% of women but only 0.1% of men. For most people, this increased metabolic rate causes the thyroid gland to become enlarged (known as a goiter).

Disorders that may affect pharmacodynamics include genetic mutations, malnutrition, thyrotoxicosis, myasthenia gravis, Parkinson's disease, and certain forms of insulin-resistant diabetes mellitus.

The U.S. Preventive Services Task Force recommends that all women age 65 years of age or older should be screened with bone densitometry.

The highest suicide rate in the United States is among people ages 65 years and older. Almost 15% of people in this age group commit suicide every year.

The use of salicylates dates back 2,500 years to Hippocrates's recommendation of willow bark (from which a salicylate is derived) as an aid to the pains of childbirth. However, overdosage of salicylates can harm body fluids, electrolytes, the CNS, the GI tract, the ears, the lungs, the blood, the liver, and the kidneys and cause coma or death.

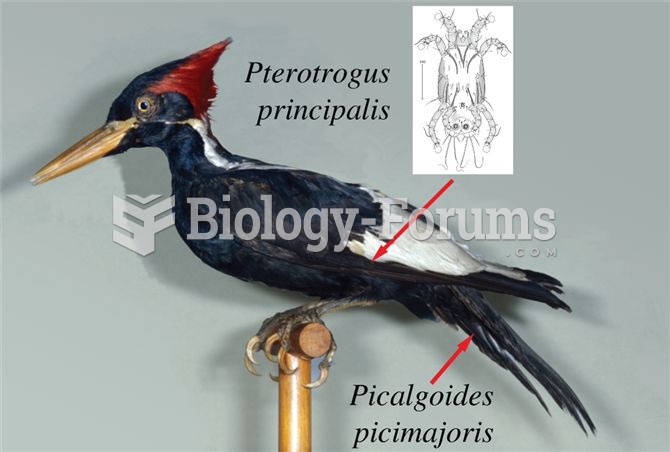

These species are all at risk of extinction. Species with “slow†life-h

These species are all at risk of extinction. Species with “slow†life-h

In the summer of 1793, a yellow fever epidemic struck Philadelphia, killing nearly 4,000. Tens of th

In the summer of 1793, a yellow fever epidemic struck Philadelphia, killing nearly 4,000. Tens of th

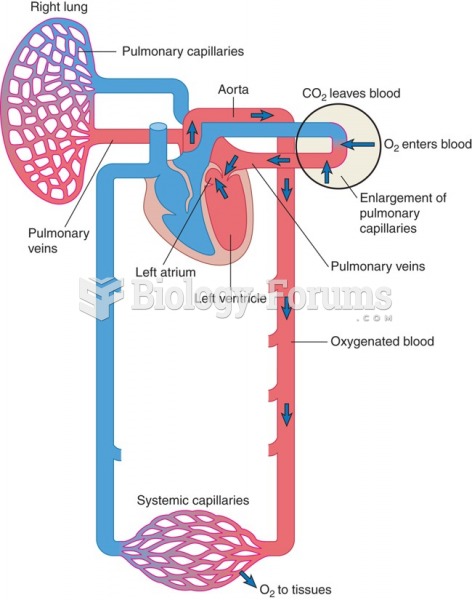

Return of oxygenated blood to the heart and entry into the aorta (red = oxygenated blood, blue = ...

Return of oxygenated blood to the heart and entry into the aorta (red = oxygenated blood, blue = ...

Patients with celiac disease must maintain a gluten-free diet. Many gluten-free items are widely ...

Patients with celiac disease must maintain a gluten-free diet. Many gluten-free items are widely ...