|

|

|

Historic treatments for rheumatoid arthritis have included gold salts, acupuncture, a diet consisting of apples or rhubarb, nutmeg, nettles, bee venom, bracelets made of copper, prayer, rest, tooth extractions, fasting, honey, vitamins, insulin, snow collected on Christmas, magnets, and electric convulsion therapy.

Human stomach acid is strong enough to dissolve small pieces of metal such as razor blades or staples.

The most common childhood diseases include croup, chickenpox, ear infections, flu, pneumonia, ringworm, respiratory syncytial virus, scabies, head lice, and asthma.

Throughout history, plants containing cardiac steroids have been used as heart drugs and as poisons (e.g., in arrows used in combat), emetics, and diuretics.

As many as 28% of hospitalized patients requiring mechanical ventilators to help them breathe (for more than 48 hours) will develop ventilator-associated pneumonia. Current therapy involves intravenous antibiotics, but new antibiotics that can be inhaled (and more directly treat the infection) are being developed.

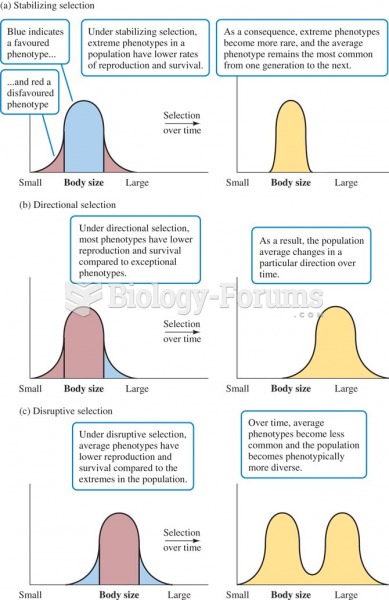

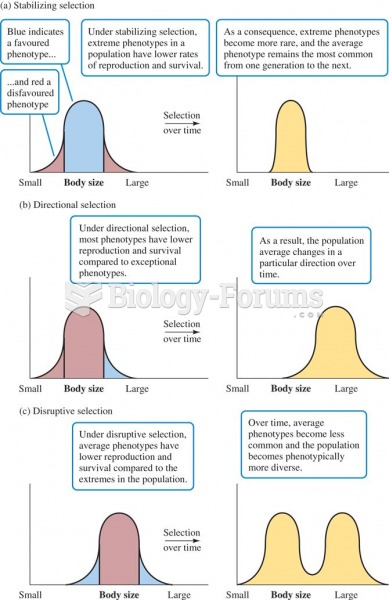

Three principle forms of natural selection: (a) stabilizing selection, (b) directional selection, an

Three principle forms of natural selection: (a) stabilizing selection, (b) directional selection, an

Three principle forms of natural selection: (a) stabilizing selection, (b) directional selection, an

Three principle forms of natural selection: (a) stabilizing selection, (b) directional selection, an