Answer to Question 1

The hedging principle, or principle of self-liquidating debt, involves matching the cash-flow-generating

characteristics of an asset with the maturity of the source of financing used to fund its acquisition.

For example, a seasonal expansion in inventories, according to the hedging principle, should be financed with a

short-term loan or current liability. The funds are needed for a limited period, and when that time has passed, the cash

needed to repay the loan will be generated by the sale of the extra inventory items.

Obtaining the needed funds from a long-term source (longer than 1 year) would mean that the firm would still have

the funds after the inventories they helped finance had been sold. In this case the firm would have excess liquidity,

which it would either hold in cash or invest in low-yield marketable securities until the seasonal increase in

inventories occurs again and the funds are needed. The result of all this would be lower profits.

Answer to Question 2

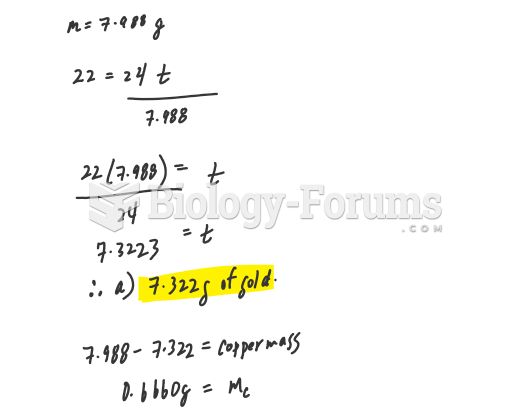

a. Initial Outlay = 1,500,000 + 20,000 = 1,520,000

Incremental Free Cash Flows:

Year 1 Year 2 Year 3 Year 4 Year 5

EBIT 600,000 700,000 550,000 200,000 100,000

Less Taxes (40) 240,000 280,000 220,000 80,000 40,000

Plus Depreciation 300,000 300,000 300,000 300,000 300,000

Operating Cash Flow 660,000 720,000 630,000 420,000 360,000

Free Cash Flow 660,000 720,000 630,000 420,000 360,000

Salvage Value 100,000

Minus Tax on Gain -40,000

Plus Recovery of

Working Capital

20,000

Terminal Cash Flow 80,000

Total Final Year Cash

Flow 440,000

b. NPV = 273,956 and the project is acceptable since the NPV is positive.

IRR = 28.73 and the project is acceptable since the IRR exceeds the required return.