|

|

|

Always store hazardous household chemicals in their original containers out of reach of children. These include bleach, paint, strippers and products containing turpentine, garden chemicals, oven cleaners, fondue fuels, nail polish, and nail polish remover.

Nitroglycerin is used to alleviate various heart-related conditions, and it is also the chief component of dynamite (but mixed in a solid clay base to stabilize it).

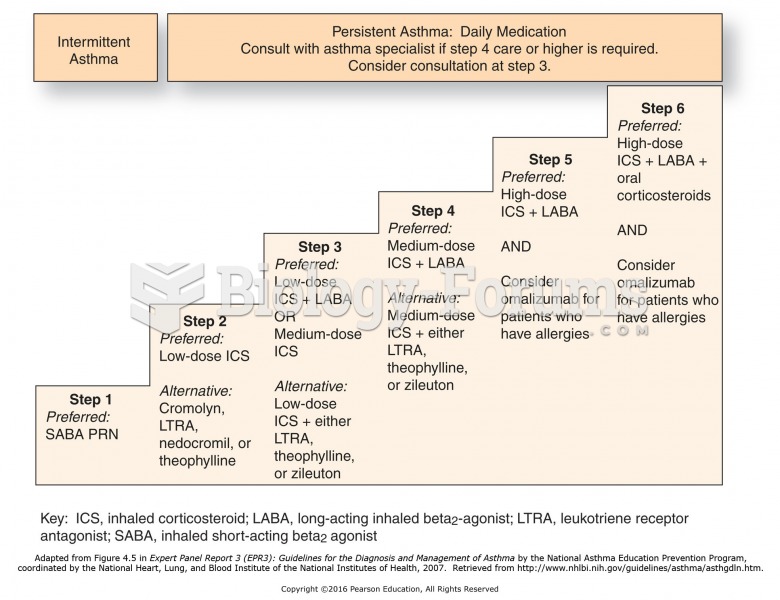

Complications of influenza include: bacterial pneumonia, ear and sinus infections, dehydration, and worsening of chronic conditions such as asthma, congestive heart failure, or diabetes.

According to the CDC, approximately 31.7% of the U.S. population has high low-density lipoprotein (LDL) or "bad cholesterol" levels.

For pediatric patients, intravenous fluids are the most commonly cited products involved in medication errors that are reported to the USP.