This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

Illicit drug use costs the United States approximately $181 billion every year.

Did you know?

Critical care patients are twice as likely to receive the wrong medication. Of these errors, 20% are life-threatening, and 42% require additional life-sustaining treatments.

Did you know?

Bacteria have been found alive in a lake buried one half mile under ice in Antarctica.

Did you know?

Serum cholesterol testing in adults is recommended every 1 to 5 years. People with diabetes and a family history of high cholesterol should be tested even more frequently.

Did you know?

The B-complex vitamins and vitamin C are not stored in the body and must be replaced each day.

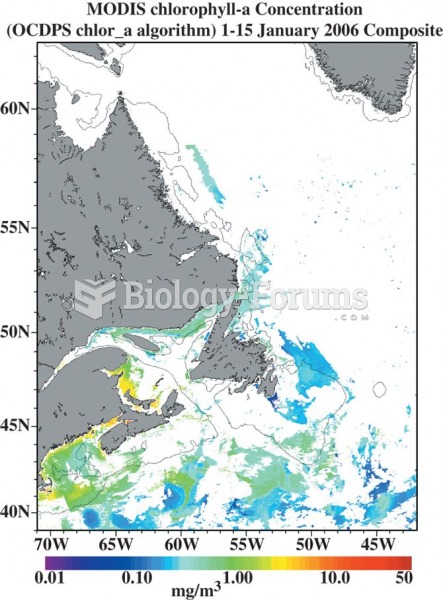

Measures of ocean chlorophyll-a concentrations from part of Atlantic Canada in (a) January 2006, and

Measures of ocean chlorophyll-a concentrations from part of Atlantic Canada in (a) January 2006, and

Forensic anthropologists working at a temporary morgue following the recovery of remains from a floo

Forensic anthropologists working at a temporary morgue following the recovery of remains from a floo