|

|

|

An identified risk factor for osteoporosis is the intake of excessive amounts of vitamin A. Dietary intake of approximately double the recommended daily amount of vitamin A, by women, has been shown to reduce bone mineral density and increase the chances for hip fractures compared with women who consumed the recommended daily amount (or less) of vitamin A.

Eat fiber! A diet high in fiber can help lower cholesterol levels by as much as 10%.

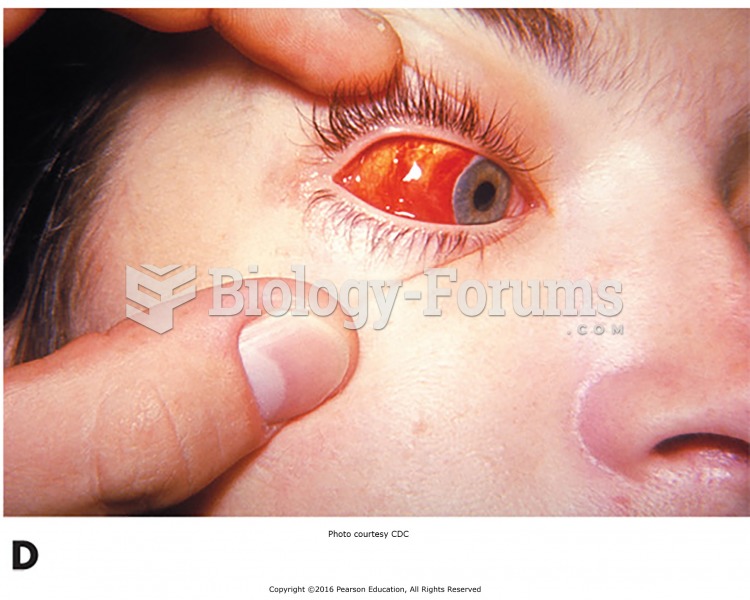

The cure for trichomoniasis is easy as long as the patient does not drink alcoholic beverages for 24 hours. Just a single dose of medication is needed to rid the body of the disease. However, without proper precautions, an individual may contract the disease repeatedly. In fact, most people develop trichomoniasis again within three months of their last treatment.

In ancient Rome, many of the richer people in the population had lead-induced gout. The reason for this is unclear. Lead poisoning has also been linked to madness.

More than 4.4billion prescriptions were dispensed within the United States in 2016.