|

|

|

Everyone has one nostril that is larger than the other.

Medications that are definitely not safe to take when breastfeeding include radioactive drugs, antimetabolites, some cancer (chemotherapy) agents, bromocriptine, ergotamine, methotrexate, and cyclosporine.

By definition, when a medication is administered intravenously, its bioavailability is 100%.

A recent study has found that following a diet rich in berries may slow down the aging process of the brain. This diet apparently helps to keep dopamine levels much higher than are seen in normal individuals who do not eat berries as a regular part of their diet as they enter their later years.

Sildenafil (Viagra®) has two actions that may be of consequence in patients with heart disease. It can lower the blood pressure, and it can interact with nitrates. It should never be used in patients who are taking nitrates.

Tense laid back ear position indicating unhappiness. Mouth and lips are also tense, which may indica

Tense laid back ear position indicating unhappiness. Mouth and lips are also tense, which may indica

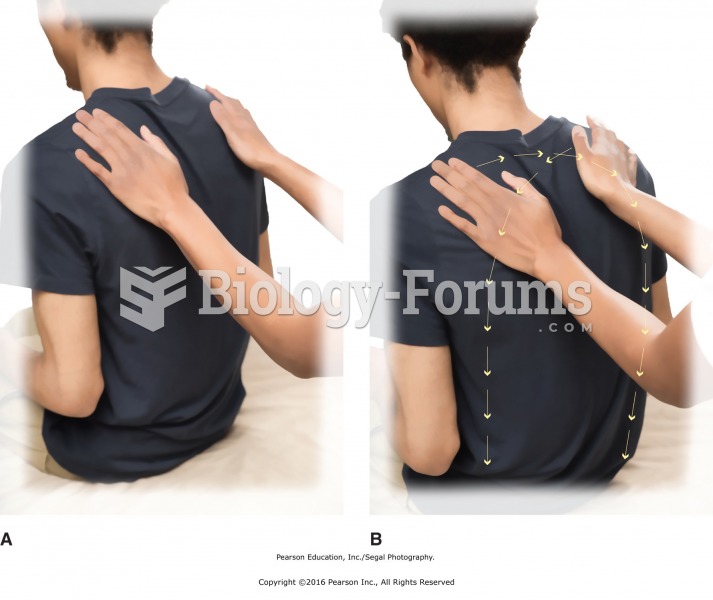

When using forearm pressure on the top of the shoulder, push with your back foot to increase your ...

When using forearm pressure on the top of the shoulder, push with your back foot to increase your ...