|

|

|

In the ancient and medieval periods, dysentery killed about ? of all babies before they reach 12 months of age. The disease was transferred through contaminated drinking water, because there was no way to adequately dispose of sewage, which contaminated the water.

According to research, pregnant women tend to eat more if carrying a baby boy. Male fetuses may secrete a chemical that stimulates their mothers to step up her energy intake.

The National Institutes of Health have supported research into acupuncture. This has shown that acupuncture significantly reduced pain associated with osteoarthritis of the knee, when used as a complement to conventional therapies.

Parkinson's disease is both chronic and progressive. This means that it persists over a long period of time and that its symptoms grow worse over time.

Fewer than 10% of babies are born on their exact due dates, 50% are born within 1 week of the due date, and 90% are born within 2 weeks of the date.

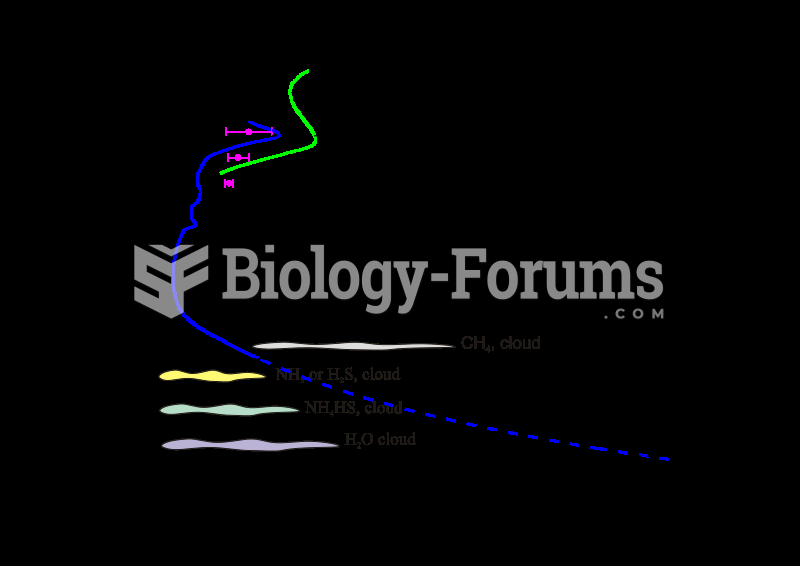

Temperature profile of the Uranian troposphere and lower stratosphere. Cloud and haze layers are als

Temperature profile of the Uranian troposphere and lower stratosphere. Cloud and haze layers are als

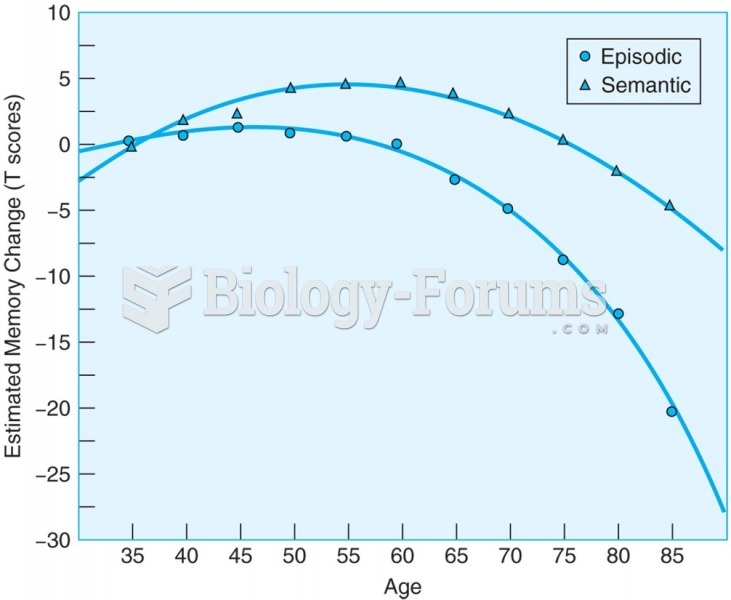

Estimated age-related changes in semantic and episodic memory abilities. Semantic memory abilities ...

Estimated age-related changes in semantic and episodic memory abilities. Semantic memory abilities ...

If a cylinder(s) is lower than most of the others, use an oil can and use two squirts of engine oil ...

If a cylinder(s) is lower than most of the others, use an oil can and use two squirts of engine oil ...