|

|

|

Immunoglobulin injections may give short-term protection against, or reduce severity of certain diseases. They help people who have an inherited problem making their own antibodies, or those who are having certain types of cancer treatments.

Autoimmune diseases occur when the immune system destroys its own healthy tissues. When this occurs, white blood cells cannot distinguish between pathogens and normal cells.

Symptoms of kidney problems include a loss of appetite, back pain (which may be sudden and intense), chills, abdominal pain, fluid retention, nausea, the urge to urinate, vomiting, and fever.

Historic treatments for rheumatoid arthritis have included gold salts, acupuncture, a diet consisting of apples or rhubarb, nutmeg, nettles, bee venom, bracelets made of copper, prayer, rest, tooth extractions, fasting, honey, vitamins, insulin, snow collected on Christmas, magnets, and electric convulsion therapy.

Atropine, along with scopolamine and hyoscyamine, is found in the Datura stramonium plant, which gives hallucinogenic effects and is also known as locoweed.

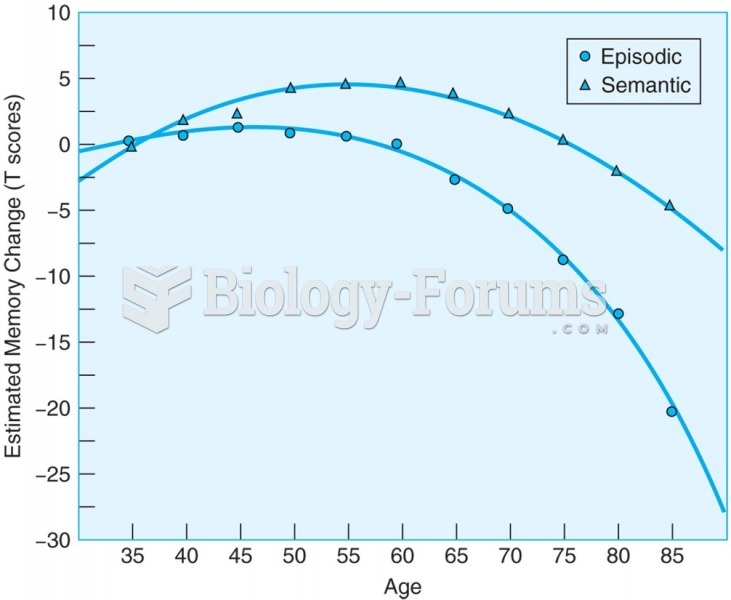

Estimated age-related changes in semantic and episodic memory abilities. Semantic memory abilities ...

Estimated age-related changes in semantic and episodic memory abilities. Semantic memory abilities ...

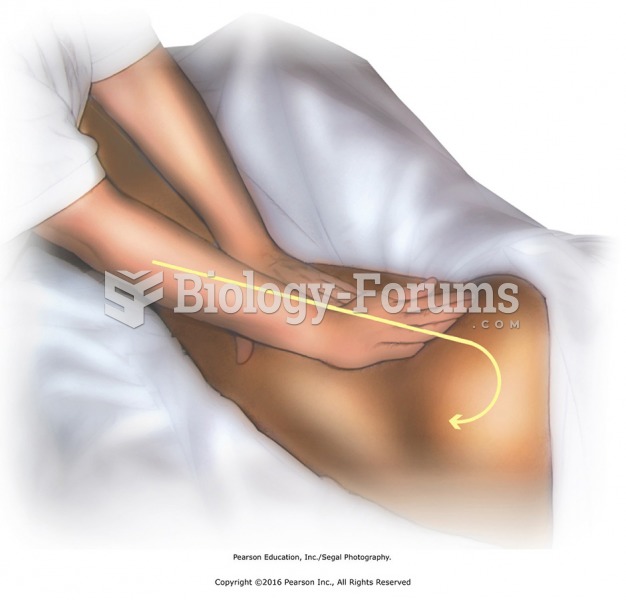

Effleurage to transition to lower leg-distal to proximal. Apply effleurage with moderate pressure to ...

Effleurage to transition to lower leg-distal to proximal. Apply effleurage with moderate pressure to ...