|

|

|

Stevens-Johnson syndrome and Toxic Epidermal Necrolysis syndrome are life-threatening reactions that can result in death. Complications include permanent blindness, dry-eye syndrome, lung damage, photophobia, asthma, chronic obstructive pulmonary disease, permanent loss of nail beds, scarring of mucous membranes, arthritis, and chronic fatigue syndrome. Many patients' pores scar shut, causing them to retain heat.

All adults should have their cholesterol levels checked once every 5 years. During 2009–2010, 69.4% of Americans age 20 and older reported having their cholesterol checked within the last five years.

Street names for barbiturates include reds, red devils, yellow jackets, blue heavens, Christmas trees, and rainbows. They are commonly referred to as downers.

The use of salicylates dates back 2,500 years to Hippocrates's recommendation of willow bark (from which a salicylate is derived) as an aid to the pains of childbirth. However, overdosage of salicylates can harm body fluids, electrolytes, the CNS, the GI tract, the ears, the lungs, the blood, the liver, and the kidneys and cause coma or death.

There are 20 feet of blood vessels in each square inch of human skin.

C, A nurse can also administer the medication by setting the dose and rate with an electronic infusi

C, A nurse can also administer the medication by setting the dose and rate with an electronic infusi

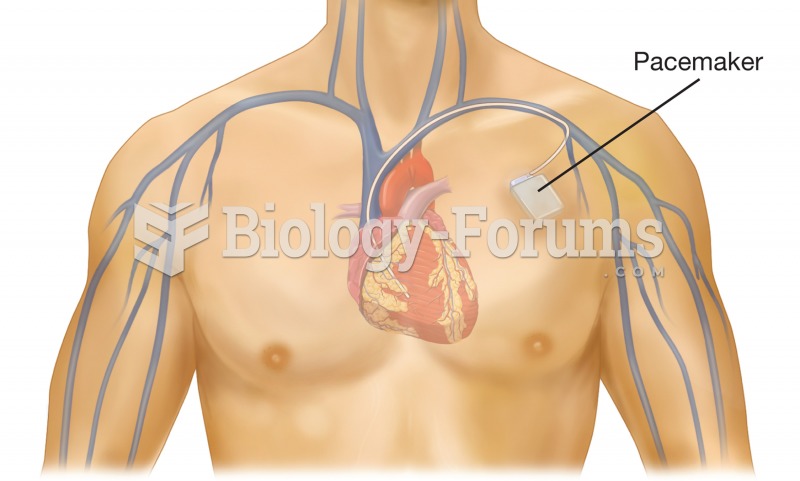

Cardiac pacemaker. The pacemaker device is implanted beneath the skin near the heart, and the electr

Cardiac pacemaker. The pacemaker device is implanted beneath the skin near the heart, and the electr