|

|

|

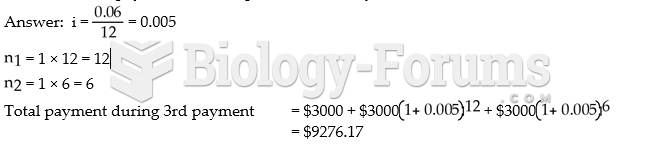

The modern decimal position system was the invention of the Hindus (around 800 AD), involving the placing of numerals to indicate their value (units, tens, hundreds, and so on).

The first monoclonal antibodies were made exclusively from mouse cells. Some are now fully human, which means they are likely to be safer and may be more effective than older monoclonal antibodies.

Fatal fungal infections may be able to resist newer antifungal drugs. Globally, fungal infections are often fatal due to the lack of access to multiple antifungals, which may be required to be utilized in combination. Single antifungals may not be enough to stop a fungal infection from causing the death of a patient.

Side effects from substance abuse include nausea, dehydration, reduced productivitiy, and dependence. Though these effects usually worsen over time, the constant need for the substance often overcomes rational thinking.

Children with strabismus (crossed eyes) can be treated. They are not able to outgrow this condition on their own, but with help, it can be more easily corrected at a younger age. It is important for infants to have eye examinations as early as possible in their development and then another at age 2 years.