This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

Sildenafil (Viagra®) has two actions that may be of consequence in patients with heart disease. It can lower the blood pressure, and it can interact with nitrates. It should never be used in patients who are taking nitrates.

Did you know?

More than 20 million Americans cite use of marijuana within the past 30 days, according to the National Survey on Drug Use and Health (NSDUH). More than 8 million admit to using it almost every day.

Did you know?

Cyanide works by making the human body unable to use oxygen.

Did you know?

Approximately one in four people diagnosed with diabetes will develop foot problems. Of these, about one-third will require lower extremity amputation.

Did you know?

The immune system needs 9.5 hours of sleep in total darkness to recharge completely.

Changes in boreal forest composition along a chronosequence in Quebec. Dates refer to the year of th

Changes in boreal forest composition along a chronosequence in Quebec. Dates refer to the year of th

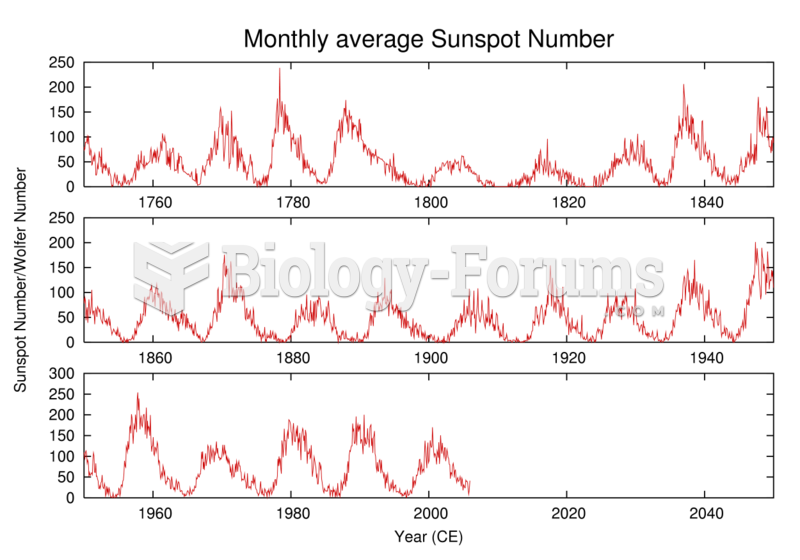

History of the number of observed sunspots during the last 250 years, which shows the ~11-year solar

History of the number of observed sunspots during the last 250 years, which shows the ~11-year solar

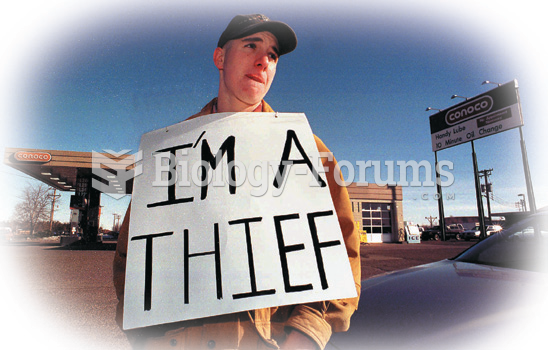

This 19-year-old in Wisconsin was given a reduced jail sentence for holding this sign in front of ...

This 19-year-old in Wisconsin was given a reduced jail sentence for holding this sign in front of ...