This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

The first documented use of surgical anesthesia in the United States was in Connecticut in 1844.

Did you know?

The FDA recognizes 118 routes of administration.

Did you know?

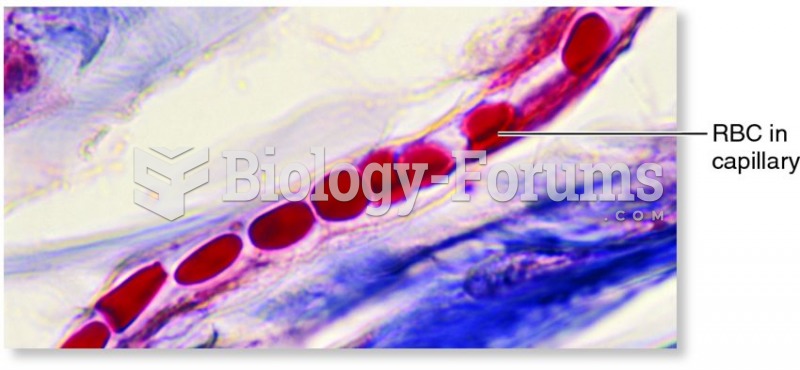

When blood is exposed to air, it clots. Heparin allows the blood to come in direct contact with air without clotting.

Did you know?

Today, nearly 8 out of 10 pregnant women living with HIV (about 1.1 million), receive antiretrovirals.

Did you know?

Increased intake of vitamin D has been shown to reduce fractures up to 25% in older people.