|

|

|

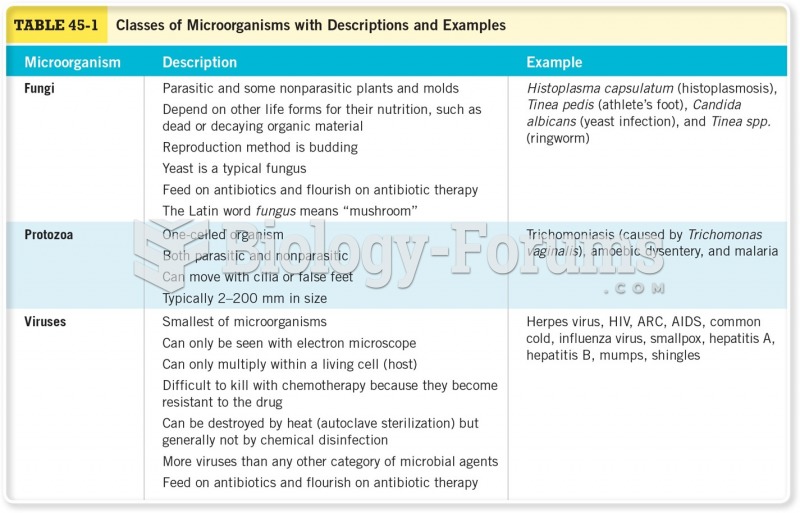

The cure for trichomoniasis is easy as long as the patient does not drink alcoholic beverages for 24 hours. Just a single dose of medication is needed to rid the body of the disease. However, without proper precautions, an individual may contract the disease repeatedly. In fact, most people develop trichomoniasis again within three months of their last treatment.

Eating food that has been cooked with poppy seeds may cause you to fail a drug screening test, because the seeds contain enough opiate alkaloids to register as a positive.

When blood is deoxygenated and flowing back to the heart through the veins, it is dark reddish-blue in color. Blood in the arteries that is oxygenated and flowing out to the body is bright red. Whereas arterial blood comes out in spurts, venous blood flows.

Many supplement containers do not even contain what their labels say. There are many documented reports of products containing much less, or more, that what is listed on their labels. They may also contain undisclosed prescription drugs and even contaminants.

It is believed that the Incas used anesthesia. Evidence supports the theory that shamans chewed cocoa leaves and drilled holes into the heads of patients (letting evil spirits escape), spitting into the wounds they made. The mixture of cocaine, saliva, and resin numbed the site enough to allow hours of drilling.