|

|

|

Thyroid conditions cause a higher risk of fibromyalgia and chronic fatigue syndrome.

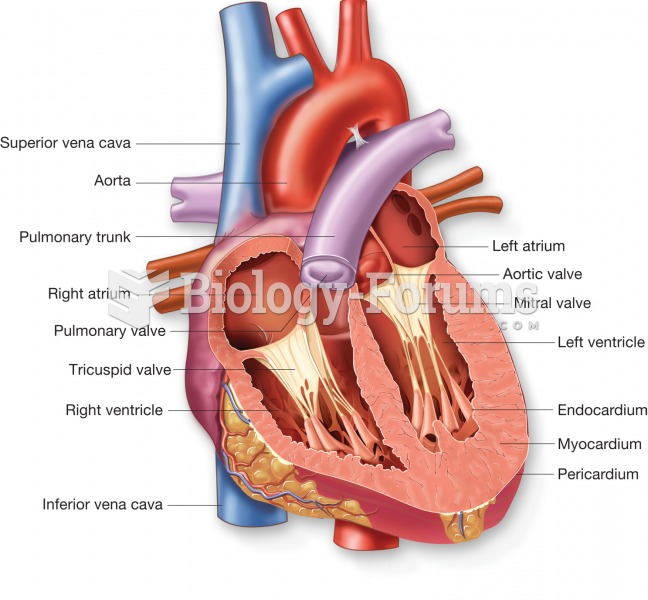

Your heart beats over 36 million times a year.

More than 150,000 Americans killed by cardiovascular disease are younger than the age of 65 years.

In 1864, the first barbiturate (barbituric acid) was synthesized.

There can actually be a 25-hour time difference between certain locations in the world. The International Date Line passes between the islands of Samoa and American Samoa. It is not a straight line, but "zig-zags" around various island chains. Therefore, Samoa and nearby islands have one date, while American Samoa and nearby islands are one day behind. Daylight saving time is used in some islands, but not in others—further shifting the hours out of sync with natural time.