|

|

|

On average, the stomach produces 2 L of hydrochloric acid per day.

Signs of depression include feeling sad most of the time for 2 weeks or longer; loss of interest in things normally enjoyed; lack of energy; sleep and appetite disturbances; weight changes; feelings of hopelessness, helplessness, or worthlessness; an inability to make decisions; and thoughts of death and suicide.

The first successful kidney transplant was performed in 1954 and occurred in Boston. A kidney from an identical twin was transplanted into his dying brother's body and was not rejected because it did not appear foreign to his body.

People with alcoholism are at a much greater risk of malnutrition than are other people and usually exhibit low levels of most vitamins (especially folic acid). This is because alcohol often takes the place of 50% of their daily intake of calories, with little nutritional value contained in it.

Nitroglycerin is used to alleviate various heart-related conditions, and it is also the chief component of dynamite (but mixed in a solid clay base to stabilize it).

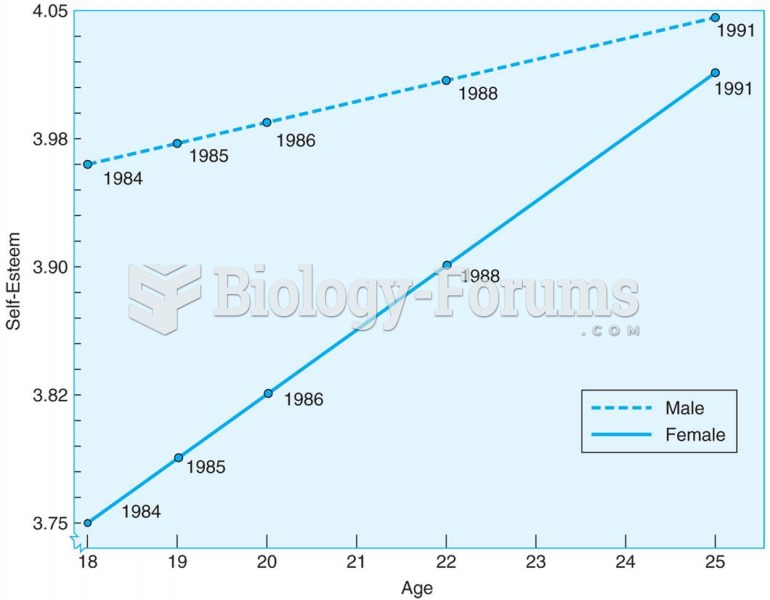

Young adults increase in self-esteem between the ages of 18 and 25, according to this longitudinal s

Young adults increase in self-esteem between the ages of 18 and 25, according to this longitudinal s

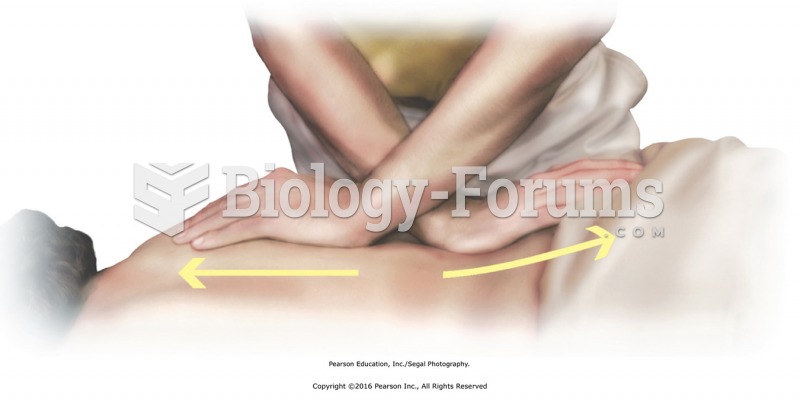

Stand facing the side of the table and apply cross-handed stretches for the subcutaneous fascia. ...

Stand facing the side of the table and apply cross-handed stretches for the subcutaneous fascia. ...