|

|

|

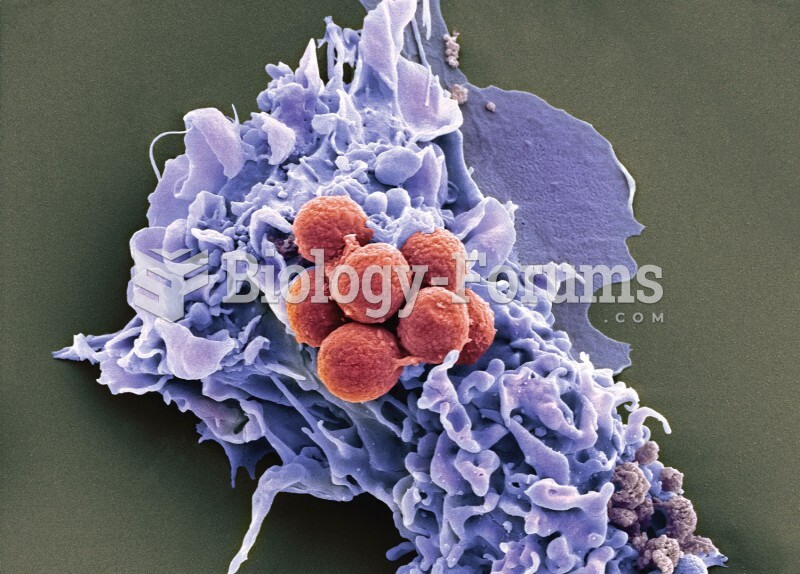

Blastomycosis is often misdiagnosed, resulting in tragic outcomes. It is caused by a fungus living in moist soil, in wooded areas of the United States and Canada. If inhaled, the fungus can cause mild breathing problems that may worsen and cause serious illness and even death.

More than 34,000 trademarked medication names and more than 10,000 generic medication names are in use in the United States.

The Centers for Disease Control and Prevention (CDC) was originally known as the Communicable Disease Center, which was formed to fight malaria. It was originally headquartered in Atlanta, Georgia, since the Southern states faced the worst threat from malaria.

The U.S. Pharmacopeia Medication Errors Reporting Program states that approximately 50% of all medication errors involve insulin.

To maintain good kidney function, you should drink at least 3 quarts of water daily. Water dilutes urine and helps prevent concentrations of salts and minerals that can lead to kidney stone formation. Chronic dehydration is a major contributor to the development of kidney stones.