|

|

|

After a vasectomy, it takes about 12 ejaculations to clear out sperm that were already beyond the blocked area.

Green tea is able to stop the scent of garlic or onion from causing bad breath.

According to the American College of Allergy, Asthma & Immunology, more than 50 million Americans have some kind of food allergy. Food allergies affect between 4 and 6% of children, and 4% of adults, according to the CDC. The most common food allergies include shellfish, peanuts, walnuts, fish, eggs, milk, and soy.

The Centers for Disease Control and Prevention has released reports detailing the deaths of infants (younger than 1 year of age) who died after being given cold and cough medications. This underscores the importance of educating parents that children younger than 2 years of age should never be given over-the-counter cold and cough medications without consulting their physicians.

Colchicine is a highly poisonous alkaloid originally extracted from a type of saffron plant that is used mainly to treat gout.

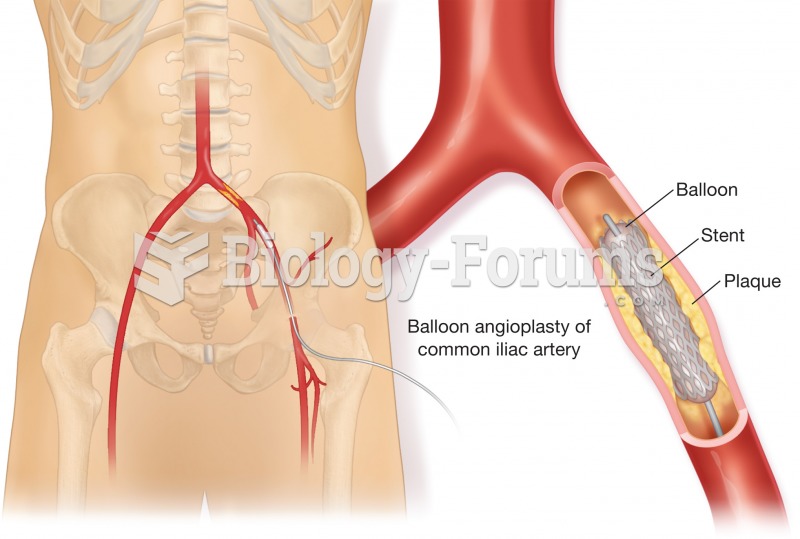

Angioplasty. One form is called balloon angioplasty, shown here. A balloon catheter is threaded into

Angioplasty. One form is called balloon angioplasty, shown here. A balloon catheter is threaded into

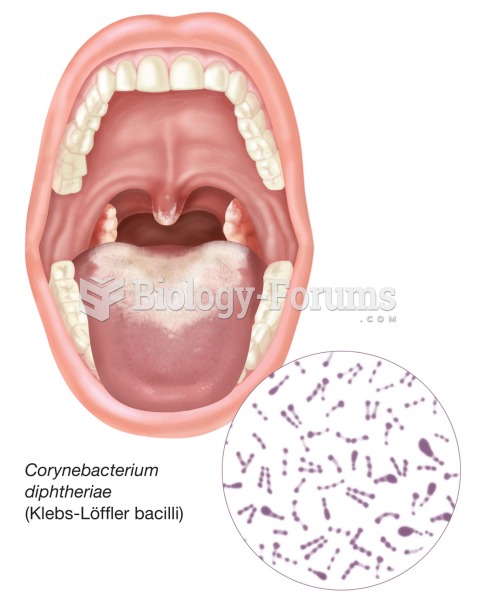

Diphtheria. The bacteria that cause this disease, called Corynebacterium diphtheriae, proliferate in

Diphtheria. The bacteria that cause this disease, called Corynebacterium diphtheriae, proliferate in

The Land Ordinance of 1785 called for surveying and dividing the Western Territories into square mil

The Land Ordinance of 1785 called for surveying and dividing the Western Territories into square mil