Answer to Question 1

Answer:

(a) The critical value for the ADF is (-2.57) at the 10 significance level for the sample period. Therefore you cannot reject the null hypothesis that there is a unit root for both inflation rates. However, given the critical value for the ADF statistic of (-3.43) you can reject the null hypothesis for the difference or the acceleration in the inflation rates at the 1 significance level. Both price levels appear to be I(2) variables.

(b) Given the critical value of (-3.96) for the EG-ADF statistic, you can reject the null hypothesis of a unit root in favor of the two inflation rates being cointegrated.

(c) The DOLS estimator allows for statistical inference on the coefficient using the standard normal distribution. Since 0.45 is more than two standard deviations from unity, you can reject the null hypothesis of that regression coefficient being one.

(d) Finding a unit slope would not be sufficient for convergence, since it would allow for a constant difference between the two inflation rates. To have convergence you would need that difference to be zero.

Answer to Question 2

Answer: When variables are forecasted separately, then single equations of the AR(p) type are typically involved. If economic theory and/or institutional knowledge suggest that additional predictors should be included, then forecasts can be potentially improved by estimating an ADL(p,q) model. For one period ahead forecasts, these are identical to forecasts based on systems of equations. Lag lengths will be chosen using the BIC or the AIC criterium.

There are three important reasons why VARs may be preferable for forecasting. One results from the forecasting horizon. If forecasts are to be made two or more periods ahead, then if future values of the additional predictors are to be used, these have to be forecasted themselves. This can be avoided by choosing the multiperiod regression method. Here, in the case of an h period forecast, multiperiod regressions are estimated where all predictors are lagged h periods or more. Second, using VAR forecasting methods will make the forecasts for the variables involved mutually consistent. This is the result of using the iterated VAR forecasts whereby the forecasted values are subsequently used to forecast further ahead. Finally VAR models allow for restrictions across equations to be tested.

Multiperiod regression methods in general may be preferable over iterated forecasts if the AR(p), ADL(p,q) or VAR models are incorrectly specified. In practice, the difference in forecasts tends to be very small between the multiperiod regression and iterated forecast methods.

VAR models can be enhanced by incorporating long-run information in the form of error correction terms. If some of the variables in the VAR model have a common stochastic trend, then this can be used to improve the forecasts by including the error correction term, thereby turning the VAR model into a VECM.

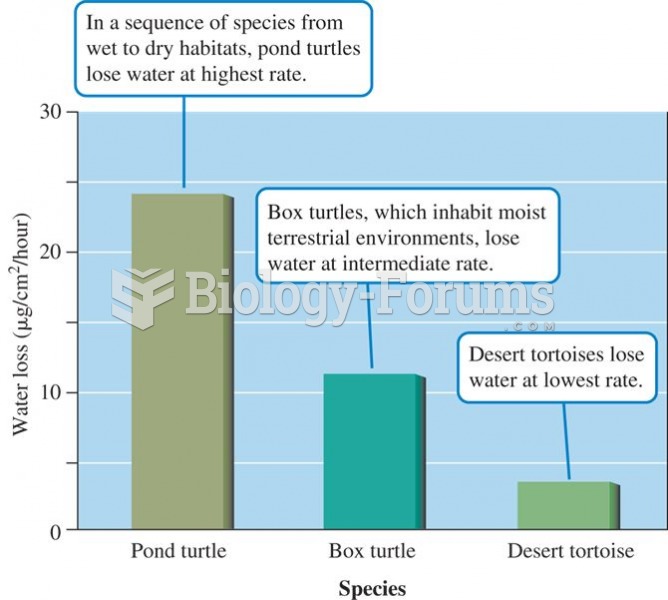

Rates of water loss by two turtles and a tortoise indicate an inverse relationship between the dryne

Rates of water loss by two turtles and a tortoise indicate an inverse relationship between the dryne

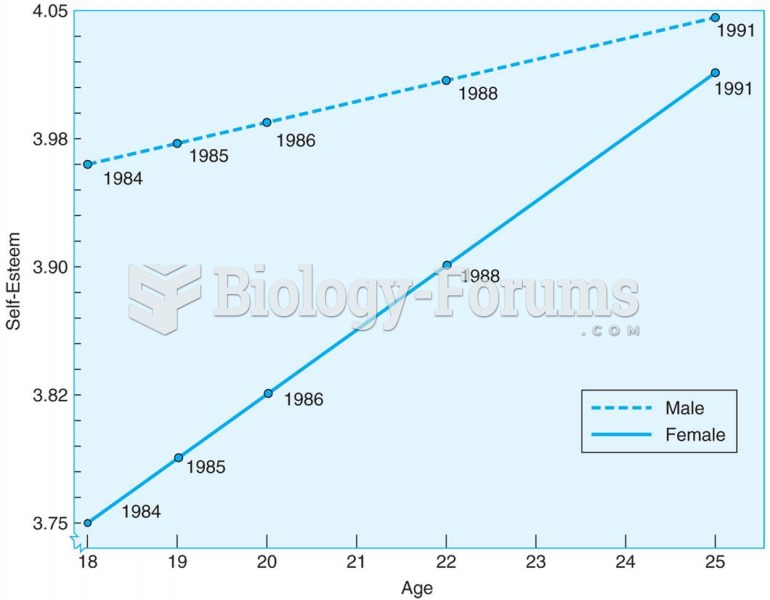

Young adults increase in self-esteem between the ages of 18 and 25, according to this longitudinal s

Young adults increase in self-esteem between the ages of 18 and 25, according to this longitudinal s