|

|

|

Did you know?

More than 4.4billion prescriptions were dispensed within the United States in 2016.

Did you know?

Bisphosphonates were first developed in the nineteenth century. They were first investigated for use in disorders of bone metabolism in the 1960s. They are now used clinically for the treatment of osteoporosis, Paget's disease, bone metastasis, multiple myeloma, and other conditions that feature bone fragility.

Did you know?

The familiar sounds of your heart are made by the heart's valves as they open and close.

Did you know?

Bacteria have flourished on the earth for over three billion years. They were the first life forms on the planet.

Did you know?

Fungal nail infections account for up to 30% of all skin infections. They affect 5% of the general population—mostly people over the age of 70.

Behavior modification has been useful in raising the amount of social responding by children with ...

Behavior modification has been useful in raising the amount of social responding by children with ...

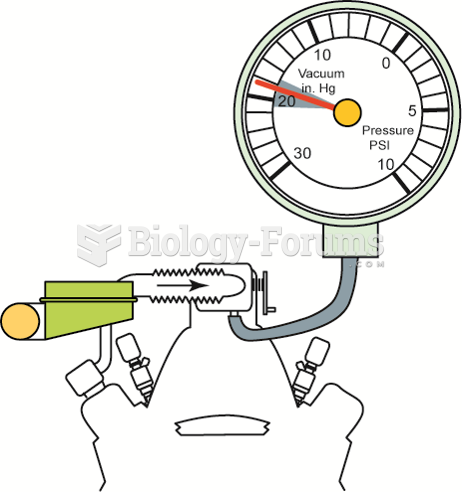

An engine in good mechanical condition should produce 17 to 21 inches Hg of vacuum at idle at sea ...

An engine in good mechanical condition should produce 17 to 21 inches Hg of vacuum at idle at sea ...