|

|

|

Most women experience menopause in their 50s. However, in 1994, an Italian woman gave birth to a baby boy when she was 61 years old.

More than 150,000 Americans killed by cardiovascular disease are younger than the age of 65 years.

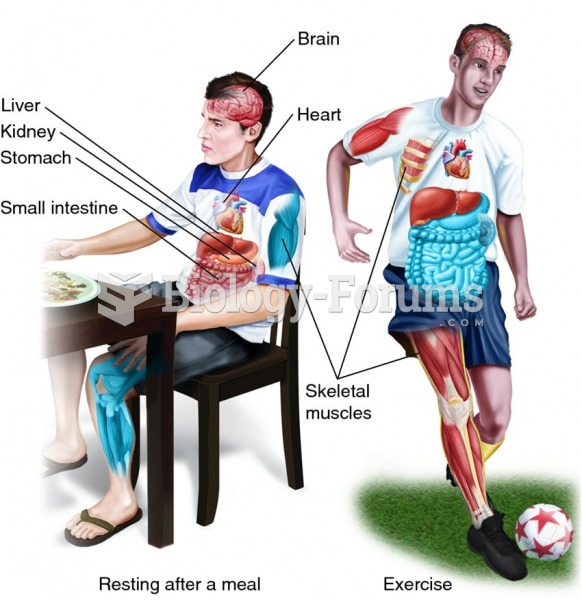

Long-term mental and physical effects from substance abuse include: paranoia, psychosis, immune deficiencies, and organ damage.

In the ancient and medieval periods, dysentery killed about ? of all babies before they reach 12 months of age. The disease was transferred through contaminated drinking water, because there was no way to adequately dispose of sewage, which contaminated the water.

Drug abusers experience the following scenario: The pleasure given by their drug (or drugs) of choice is so strong that it is difficult to eradicate even after years of staying away from the substances involved. Certain triggers may cause a drug abuser to relapse. Research shows that long-term drug abuse results in significant changes in brain function that persist long after an individual stops using drugs. It is most important to realize that the same is true of not just illegal substances but alcohol and tobacco as well.