|

|

|

To combat osteoporosis, changes in lifestyle and diet are recommended. At-risk patients should include 1,200 to 1,500 mg of calcium daily either via dietary means or with supplements.

Barbituric acid, the base material of barbiturates, was first synthesized in 1863 by Adolph von Bayer. His company later went on to synthesize aspirin for the first time, and Bayer aspirin is still a popular brand today.

In the United States, there is a birth every 8 seconds, according to the U.S. Census Bureau's Population Clock.

Cocaine was isolated in 1860 and first used as a local anesthetic in 1884. Its first clinical use was by Sigmund Freud to wean a patient from morphine addiction. The fictional character Sherlock Holmes was supposed to be addicted to cocaine by injection.

Many of the drugs used by neuroscientists are derived from toxic plants and venomous animals (such as snakes, spiders, snails, and puffer fish).

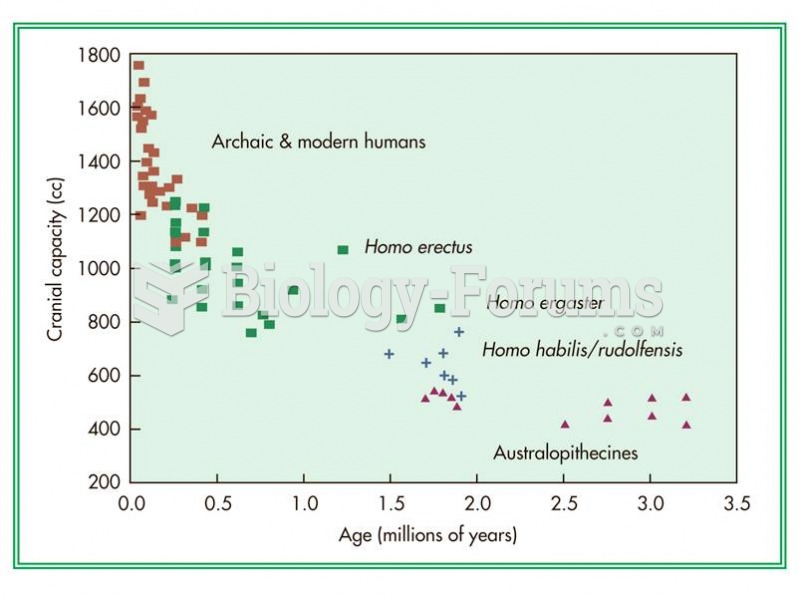

Cranial capacity has increased approximately fourfold over the last 3.5 million years of hominin evo

Cranial capacity has increased approximately fourfold over the last 3.5 million years of hominin evo

In 2009, historian Woody Holton described how Abigail Adams shrewdly invested in the Continental Con

In 2009, historian Woody Holton described how Abigail Adams shrewdly invested in the Continental Con