|

|

|

Patients who have undergone chemotherapy for the treatment of cancer often complain of a lack of mental focus; memory loss; and a general diminution in abilities such as multitasking, attention span, and general mental agility.

Most fungi that pathogenically affect humans live in soil. If a person is not healthy, has an open wound, or is immunocompromised, a fungal infection can be very aggressive.

During pregnancy, a woman is more likely to experience bleeding gums and nosebleeds caused by hormonal changes that increase blood flow to the mouth and nose.

Cutaneous mucormycosis is a rare fungal infection that has been fatal in at least 29% of cases, and in as many as 83% of cases, depending on the patient's health prior to infection. It has occurred often after natural disasters such as tornados, and early treatment is essential.

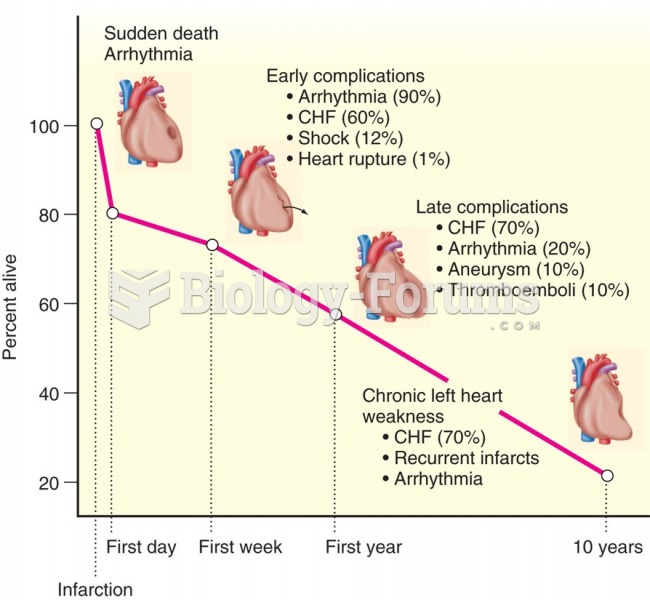

The heart is located in the center of the chest, with part of it tipped slightly so that it taps against the left side of the chest.