|

|

|

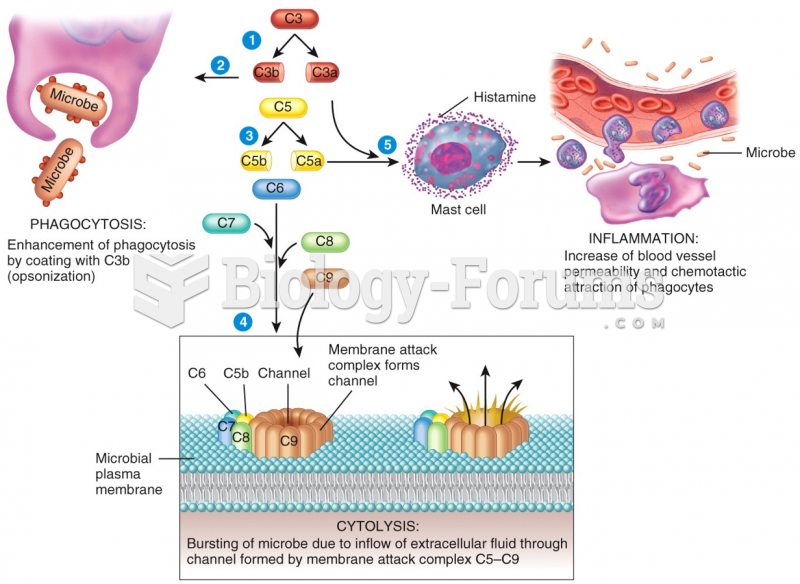

Chronic marijuana use can damage the white blood cells and reduce the immune system's ability to respond to disease by as much as 40%. Without a strong immune system, the body is vulnerable to all kinds of degenerative and infectious diseases.

Liver spots have nothing whatsoever to do with the liver. They are a type of freckles commonly seen in older adults who have been out in the sun without sufficient sunscreen.

On average, someone in the United States has a stroke about every 40 seconds. This is about 795,000 people per year.

Excessive alcohol use costs the country approximately $235 billion every year.

The use of salicylates dates back 2,500 years to Hippocrates's recommendation of willow bark (from which a salicylate is derived) as an aid to the pains of childbirth. However, overdosage of salicylates can harm body fluids, electrolytes, the CNS, the GI tract, the ears, the lungs, the blood, the liver, and the kidneys and cause coma or death.