|

|

|

Most childhood vaccines are 90–99% effective in preventing disease. Side effects are rarely serious.

Malaria mortality rates are falling. Increased malaria prevention and control measures have greatly improved these rates. Since 2000, malaria mortality rates have fallen globally by 60% among all age groups, and by 65% among children under age 5.

According to the Migraine Research Foundation, migraines are the third most prevalent illness in the world. Women are most affected (18%), followed by children of both sexes (10%), and men (6%).

Egg cells are about the size of a grain of sand. They are formed inside of a female's ovaries before she is even born.

A recent study has found that following a diet rich in berries may slow down the aging process of the brain. This diet apparently helps to keep dopamine levels much higher than are seen in normal individuals who do not eat berries as a regular part of their diet as they enter their later years.

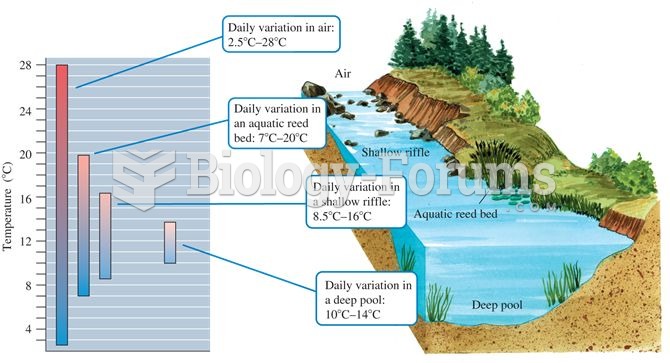

Aquatic microclimates: aquatic environments generally show less temperature variation compared to te

Aquatic microclimates: aquatic environments generally show less temperature variation compared to te

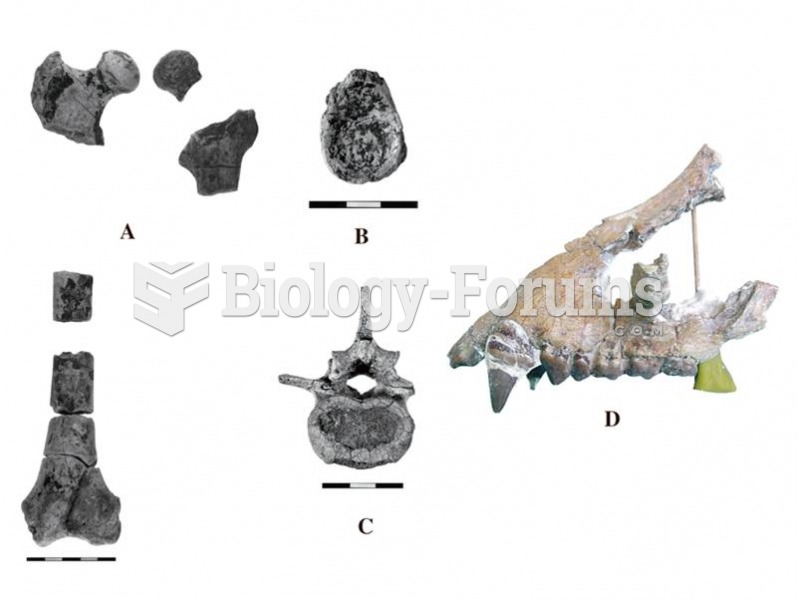

Morotopithecus is the earliest fossil ape to show postcranial adaptations similar to those of the li

Morotopithecus is the earliest fossil ape to show postcranial adaptations similar to those of the li