|

|

|

The first successful kidney transplant was performed in 1954 and occurred in Boston. A kidney from an identical twin was transplanted into his dying brother's body and was not rejected because it did not appear foreign to his body.

Pubic lice (crabs) are usually spread through sexual contact. You cannot catch them by using a public toilet.

About 3.2 billion people, nearly half the world population, are at risk for malaria. In 2015, there are about 214 million malaria cases and an estimated 438,000 malaria deaths.

Interferon was scarce and expensive until 1980, when the interferon gene was inserted into bacteria using recombinant DNA technology, allowing for mass cultivation and purification from bacterial cultures.

Human stomach acid is strong enough to dissolve small pieces of metal such as razor blades or staples.

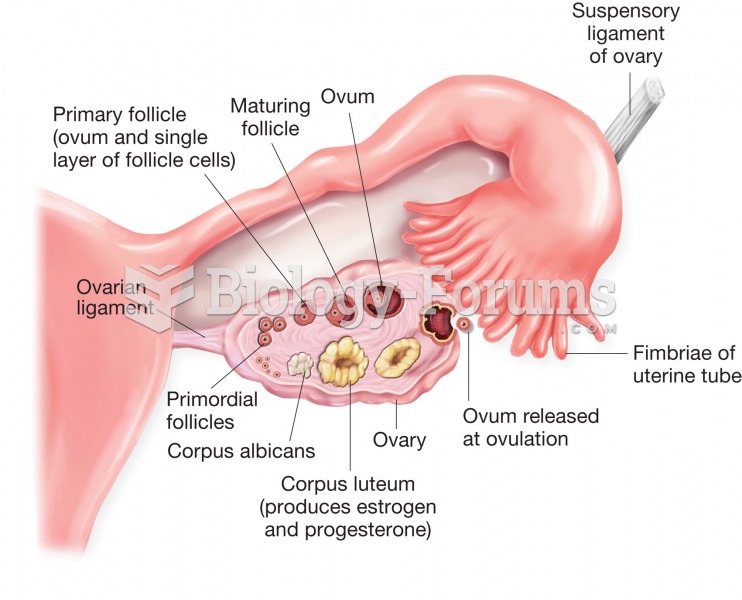

Structure of the ovary and uterine (fallopian) tube. Figure illustrates stages of ovum development a

Structure of the ovary and uterine (fallopian) tube. Figure illustrates stages of ovum development a

In 2013, Americans learned that the federal government massively surveys their phone calls and e-mai

In 2013, Americans learned that the federal government massively surveys their phone calls and e-mai

The world attempted to deal with Somalia as if it were a real country but painfully learned that Som

The world attempted to deal with Somalia as if it were a real country but painfully learned that Som