|

|

|

Congestive heart failure is a serious disorder that carries a reduced life expectancy. Heart failure is usually a chronic illness, and it may worsen with infection or other physical stressors.

The training of an anesthesiologist typically requires four years of college, 4 years of medical school, 1 year of internship, and 3 years of residency.

A cataract is a clouding of the eyes' natural lens. As we age, some clouding of the lens may occur. The first sign of a cataract is usually blurry vision. Although glasses and other visual aids may at first help a person with cataracts, surgery may become inevitable. Cataract surgery is very successful in restoring vision, and it is the most frequently performed surgery in the United States.

Urine turns bright yellow if larger than normal amounts of certain substances are consumed; one of these substances is asparagus.

The B-complex vitamins and vitamin C are not stored in the body and must be replaced each day.

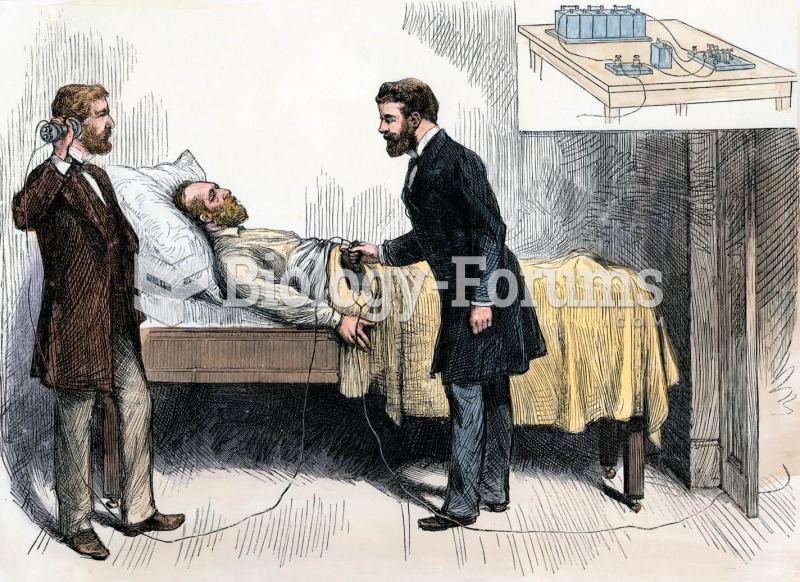

James A. Garfield lies mortally wounded. After failing to locate the bullet, surgeons called in Alex

James A. Garfield lies mortally wounded. After failing to locate the bullet, surgeons called in Alex

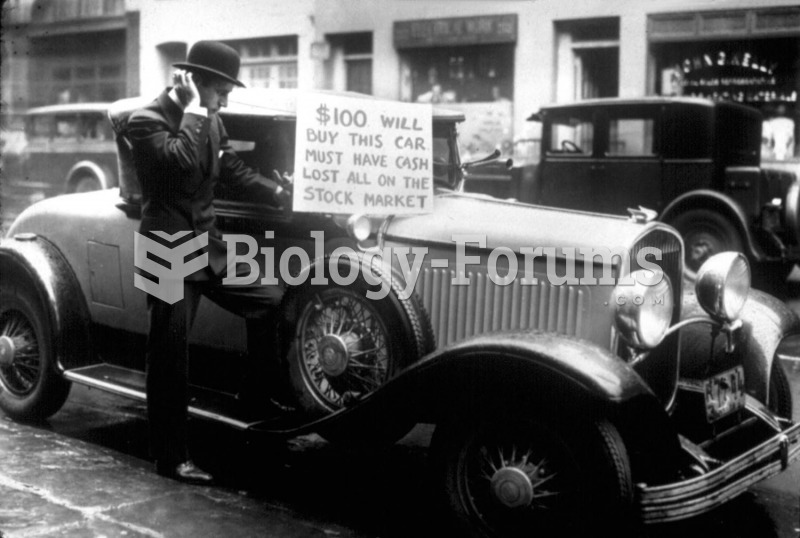

Walter Thompson saw his assets evaporate during the stock market collapse in 1929. Desperate for ...

Walter Thompson saw his assets evaporate during the stock market collapse in 1929. Desperate for ...