|

|

|

More than 20 million Americans cite use of marijuana within the past 30 days, according to the National Survey on Drug Use and Health (NSDUH). More than 8 million admit to using it almost every day.

Sperm cells are so tiny that 400 to 500 million (400,000,000–500,000,000) of them fit onto 1 tsp.

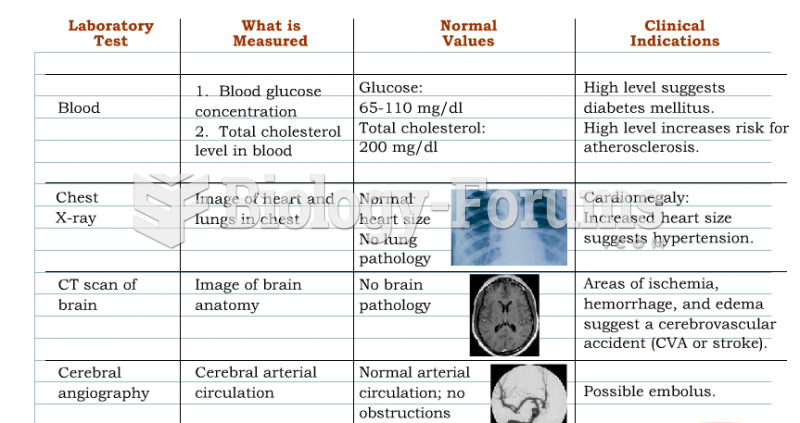

On average, someone in the United States has a stroke about every 40 seconds. This is about 795,000 people per year.

Historic treatments for rheumatoid arthritis have included gold salts, acupuncture, a diet consisting of apples or rhubarb, nutmeg, nettles, bee venom, bracelets made of copper, prayer, rest, tooth extractions, fasting, honey, vitamins, insulin, snow collected on Christmas, magnets, and electric convulsion therapy.

One way to reduce acid reflux is to lose two or three pounds. Most people lose weight in the belly area first when they increase exercise, meaning that heartburn can be reduced quickly by this method.