|

|

|

Did you know?

The first oral chemotherapy drug for colon cancer was approved by FDA in 2001.

Did you know?

The ratio of hydrogen atoms to oxygen in water (H2O) is 2:1.

Did you know?

The familiar sounds of your heart are made by the heart's valves as they open and close.

Did you know?

Asthma is the most common chronic childhood disease in the world. Most children who develop asthma have symptoms before they are 5 years old.

Did you know?

Multiple experimental evidences have confirmed that at the molecular level, cancer is caused by lesions in cellular DNA.

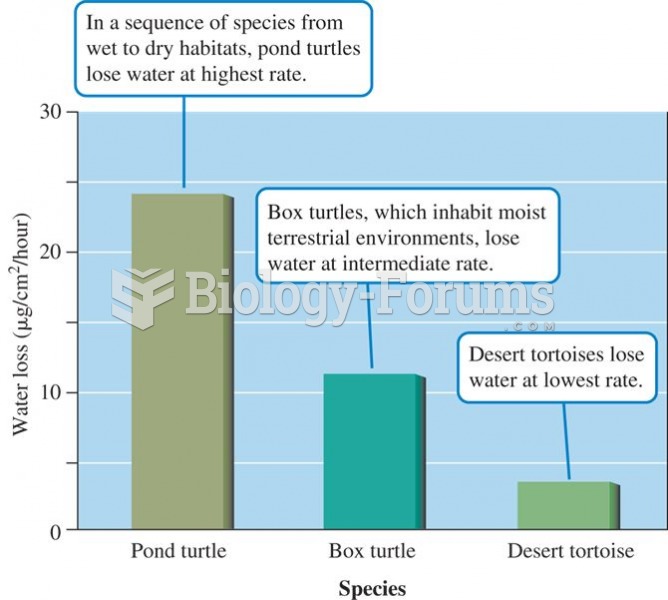

Rates of water loss by two turtles and a tortoise indicate an inverse relationship between the dryne

Rates of water loss by two turtles and a tortoise indicate an inverse relationship between the dryne

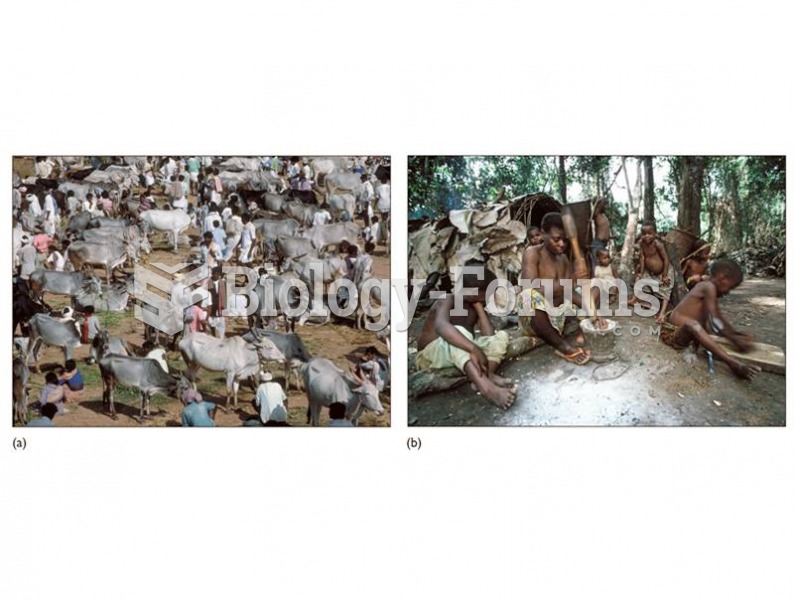

Risks of infectious disease increase in (a) high-density agricultural populations compared to (b) lo

Risks of infectious disease increase in (a) high-density agricultural populations compared to (b) lo