|

|

|

Bisphosphonates were first developed in the nineteenth century. They were first investigated for use in disorders of bone metabolism in the 1960s. They are now used clinically for the treatment of osteoporosis, Paget's disease, bone metastasis, multiple myeloma, and other conditions that feature bone fragility.

When Gabriel Fahrenheit invented the first mercury thermometer, he called "zero degrees" the lowest temperature he was able to attain with a mixture of ice and salt. For the upper point of his scale, he used 96°, which he measured as normal human body temperature (we know it to be 98.6° today because of more accurate thermometers).

Stevens-Johnson syndrome and Toxic Epidermal Necrolysis syndrome are life-threatening reactions that can result in death. Complications include permanent blindness, dry-eye syndrome, lung damage, photophobia, asthma, chronic obstructive pulmonary disease, permanent loss of nail beds, scarring of mucous membranes, arthritis, and chronic fatigue syndrome. Many patients' pores scar shut, causing them to retain heat.

Egg cells are about the size of a grain of sand. They are formed inside of a female's ovaries before she is even born.

Common abbreviations that cause medication errors include U (unit), mg (milligram), QD (every day), SC (subcutaneous), TIW (three times per week), D/C (discharge or discontinue), HS (at bedtime or "hours of sleep"), cc (cubic centimeters), and AU (each ear).

During their annual migration, the entire population of Arctic terns move from the Arctic Ocean in t

During their annual migration, the entire population of Arctic terns move from the Arctic Ocean in t

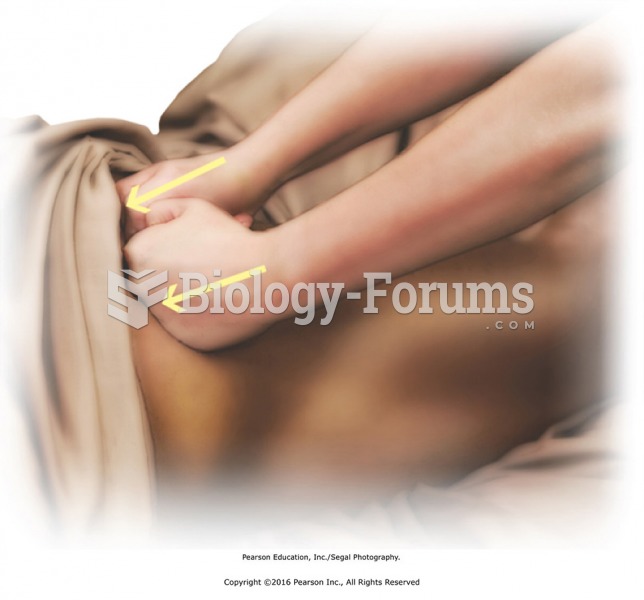

Apply compressions over the entire buttocks region with the fist using moderate to heavy pressure. ...

Apply compressions over the entire buttocks region with the fist using moderate to heavy pressure. ...

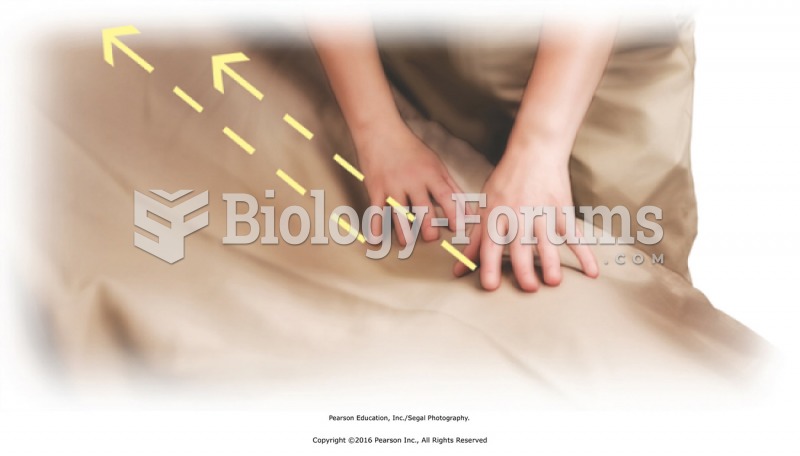

Finishing techniques to entire leg. Start with basic effleurage from ankle to hip. Redrape the leg. ...

Finishing techniques to entire leg. Start with basic effleurage from ankle to hip. Redrape the leg. ...

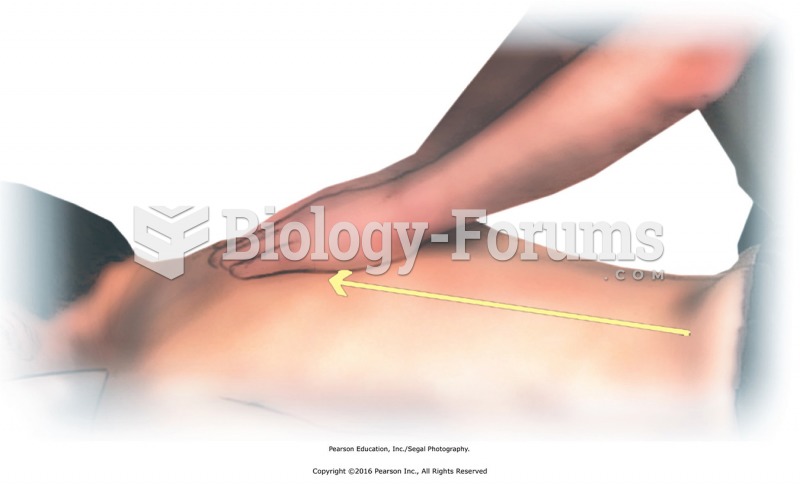

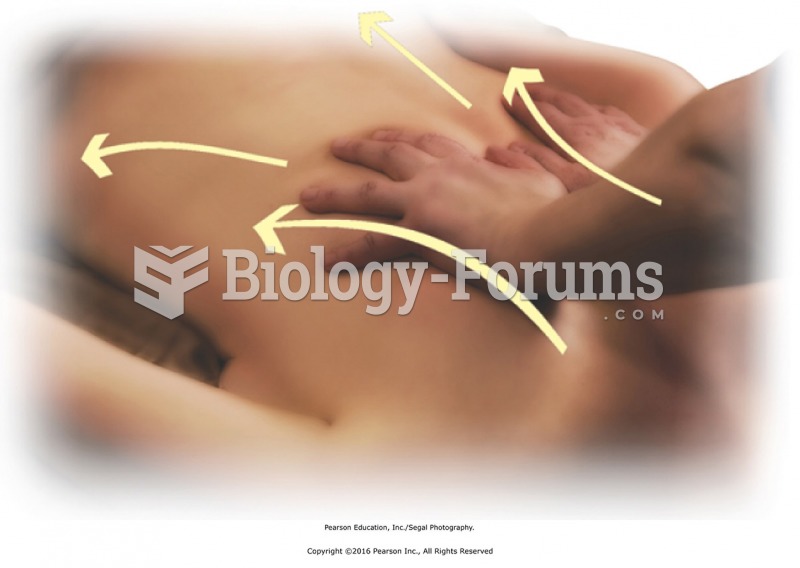

Finish with bilateral stroking to the entire back. Stand at head of the table with fingers pointing ...

Finish with bilateral stroking to the entire back. Stand at head of the table with fingers pointing ...