This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

Critical care patients are twice as likely to receive the wrong medication. Of these errors, 20% are life-threatening, and 42% require additional life-sustaining treatments.

Did you know?

Autoimmune diseases occur when the immune system destroys its own healthy tissues. When this occurs, white blood cells cannot distinguish between pathogens and normal cells.

Did you know?

Green tea is able to stop the scent of garlic or onion from causing bad breath.

Did you know?

Each year in the United States, there are approximately six million pregnancies. This means that at any one time, about 4% of women in the United States are pregnant.

Did you know?

You should not take more than 1,000 mg of vitamin E per day. Doses above this amount increase the risk of bleeding problems that can lead to a stroke.

Astronaut Piers Sellers during the third spacewalk of STS-121, a demonstration of orbiter heat shiel

Astronaut Piers Sellers during the third spacewalk of STS-121, a demonstration of orbiter heat shiel

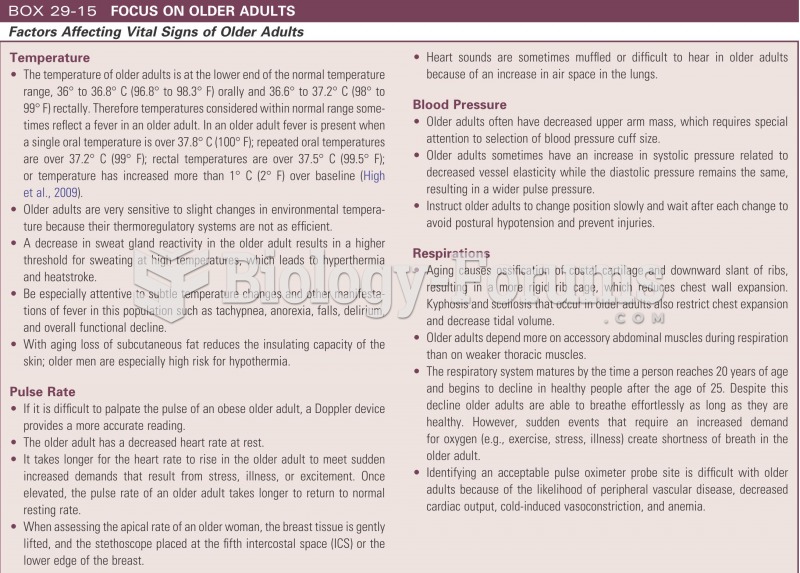

Vital signs for clients in metabolic alkalosis may reveal hypotension, bradycardia, and an irregular

Vital signs for clients in metabolic alkalosis may reveal hypotension, bradycardia, and an irregular