|

|

|

More than one-third of adult Americans are obese. Diseases that kill the largest number of people annually, such as heart disease, cancer, diabetes, stroke, and hypertension, can be attributed to diet.

The longest a person has survived after a heart transplant is 24 years.

The toxic levels for lithium carbonate are close to the therapeutic levels. Signs of toxicity include fine hand tremor, polyuria, mild thirst, nausea, general discomfort, diarrhea, vomiting, drowsiness, muscular weakness, lack of coordination, ataxia, giddiness, tinnitus, and blurred vision.

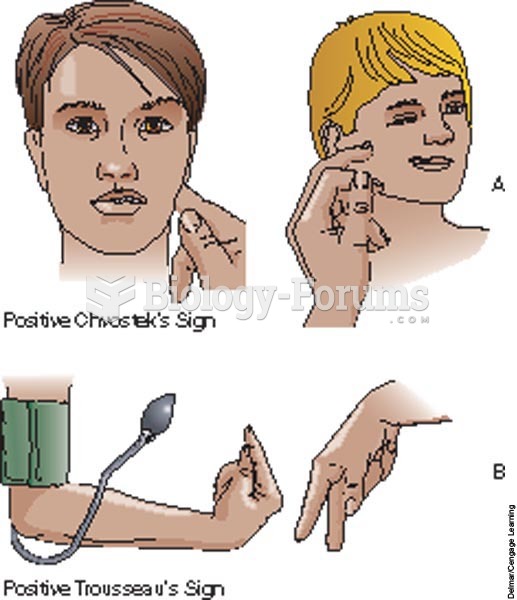

Calcitonin is a naturally occurring hormone. In women who are at least 5 years beyond menopause, it slows bone loss and increases spinal bone density.

In 1844, Charles Goodyear obtained the first patent for a rubber condom.

The recent mass upheavals in Tunisia, Egypt, Libya, Yemen, and Syria gave political scientists a cha

The recent mass upheavals in Tunisia, Egypt, Libya, Yemen, and Syria gave political scientists a cha

Historian James Merrell notes several errors in Benjamin West’s famous 1771 painting, William Penn’s

Historian James Merrell notes several errors in Benjamin West’s famous 1771 painting, William Penn’s