|

|

|

Did you know?

If all the neurons in the human body were lined up, they would stretch more than 600 miles.

Did you know?

It is difficult to obtain enough calcium without consuming milk or other dairy foods.

Did you know?

Long-term mental and physical effects from substance abuse include: paranoia, psychosis, immune deficiencies, and organ damage.

Did you know?

There are more sensory neurons in the tongue than in any other part of the body.

Did you know?

Bacteria have been found alive in a lake buried one half mile under ice in Antarctica.

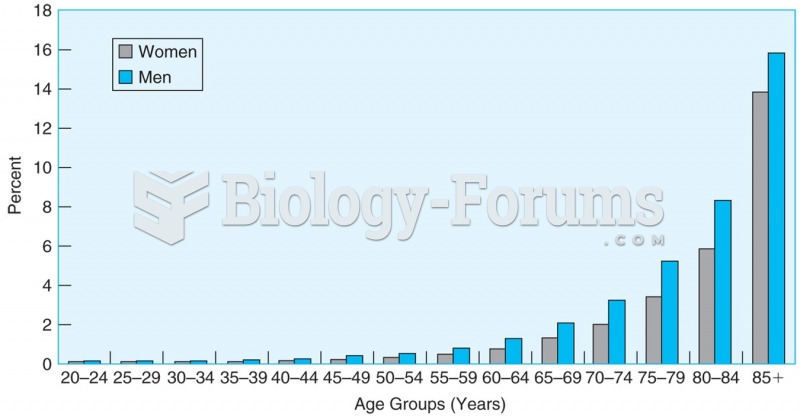

The mortality rate in the United States increases with age and is lower for women than men at every ...

The mortality rate in the United States increases with age and is lower for women than men at every ...

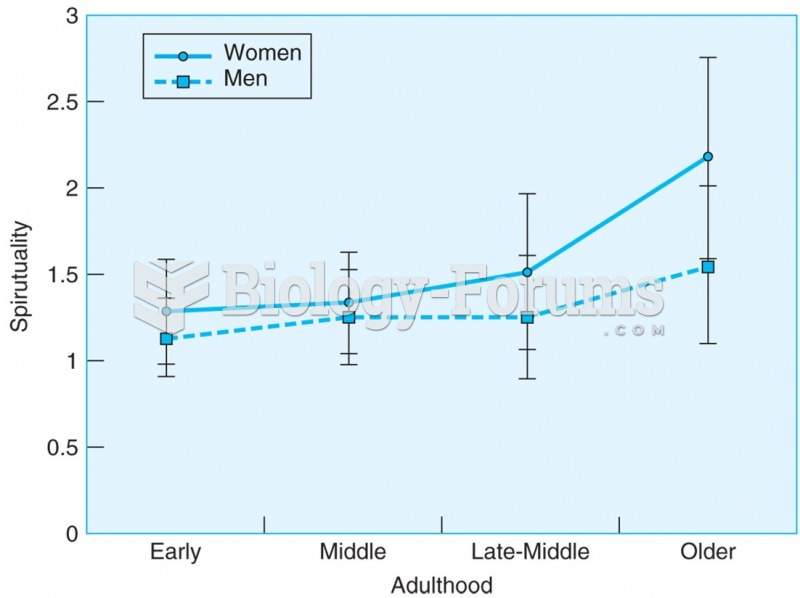

Spirituality increases with age, but there are different patterns for the two genders. Both genders ...

Spirituality increases with age, but there are different patterns for the two genders. Both genders ...