|

|

|

The use of salicylates dates back 2,500 years to Hippocrates’s recommendation of willow bark (from which a salicylate is derived) as an aid to the pains of childbirth. However, overdosage of salicylates can harm body fluids, electrolytes, the CNS, the GI tract, the ears, the lungs, the blood, the liver, and the kidneys and cause coma or death.

Your skin wrinkles if you stay in the bathtub a long time because the outermost layer of skin (which consists of dead keratin) swells when it absorbs water. It is tightly attached to the skin below it, so it compensates for the increased area by wrinkling. This happens to the hands and feet because they have the thickest layer of dead keratin cells.

Hippocrates noted that blood separates into four differently colored liquids when removed from the body and examined: a pure red liquid mixed with white liquid material with a yellow-colored froth at the top and a black substance that settles underneath; he named these the four humors (for blood, phlegm, yellow bile, and black bile).

About 60% of newborn infants in the United States are jaundiced; that is, they look yellow. Kernicterus is a form of brain damage caused by excessive jaundice. When babies begin to be affected by excessive jaundice and begin to have brain damage, they become excessively lethargic.

Recent studies have shown that the number of medication errors increases in relation to the number of orders that are verified per pharmacist, per work shift.

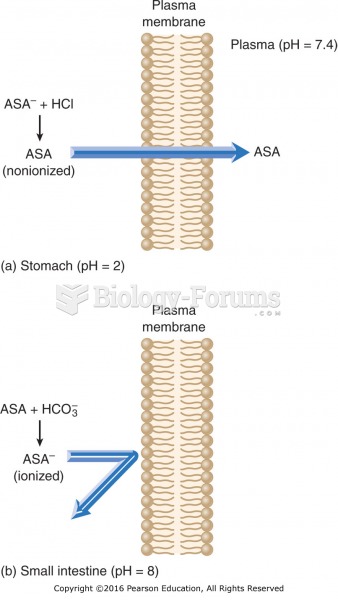

Effect of pH on drug absorption: (a) A weak acid such as aspirin (ASA) is in a nonionized form in an ...

Effect of pH on drug absorption: (a) A weak acid such as aspirin (ASA) is in a nonionized form in an ...

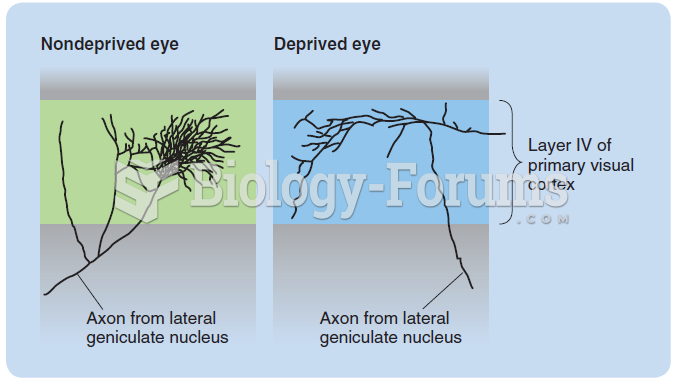

The effect of a few days of early monocular deprivation on the structure of axons projecting from ...

The effect of a few days of early monocular deprivation on the structure of axons projecting from ...

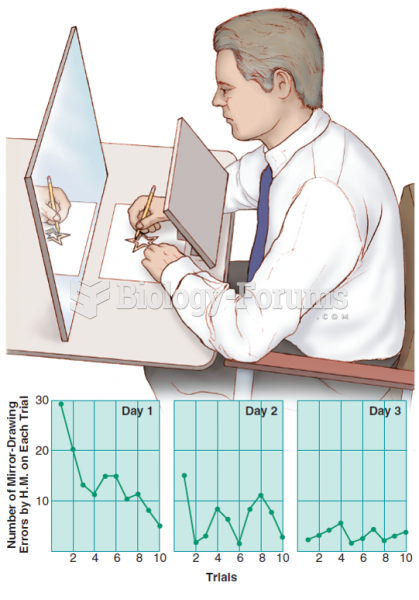

The learning and retention of the mirrordrawing task by H.M. Despite his good retention of the task, ...

The learning and retention of the mirrordrawing task by H.M. Despite his good retention of the task, ...