|

|

|

There are actually 60 minerals, 16 vitamins, 12 essential amino acids, and three essential fatty acids that your body needs every day.

Drying your hands with a paper towel will reduce the bacterial count on your hands by 45–60%.

A seasonal flu vaccine is the best way to reduce the chances you will get seasonal influenza and spread it to others.

Though newer “smart” infusion pumps are increasingly becoming more sophisticated, they cannot prevent all programming and administration errors. Health care professionals that use smart infusion pumps must still practice the rights of medication administration and have other professionals double-check all high-risk infusions.

The oldest recorded age was 122. Madame Jeanne Calment was born in France in 1875 and died in 1997. She was a vegetarian and loved olive oil, port wine, and chocolate.

The United States is the most racially– ethnically diverse society in the world. This can be our ...

The United States is the most racially– ethnically diverse society in the world. This can be our ...

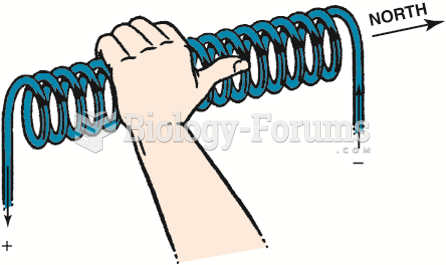

The left-hand rule states that if a coil is grasped with the left hand, the fingers will point in ...

The left-hand rule states that if a coil is grasped with the left hand, the fingers will point in ...