|

|

|

Did you know?

All adverse reactions are commonly charted in red ink in the patient's record and usually are noted on the front of the chart. Failure to follow correct documentation procedures may result in malpractice lawsuits.

Did you know?

In 1864, the first barbiturate (barbituric acid) was synthesized.

Did you know?

Cytomegalovirus affects nearly the same amount of newborns every year as Down syndrome.

Did you know?

The modern decimal position system was the invention of the Hindus (around 800 AD), involving the placing of numerals to indicate their value (units, tens, hundreds, and so on).

Did you know?

Of the estimated 2 million heroin users in the United States, 600,000–800,000 are considered hardcore addicts. Heroin addiction is considered to be one of the hardest addictions to recover from.

Open-top chambers, such as the one pictured above in a polar desert on Ellesmere Island, are commonl

Open-top chambers, such as the one pictured above in a polar desert on Ellesmere Island, are commonl

Chimpanzees live in complex kin groups in which lifelong bonds and individual personalities play key

Chimpanzees live in complex kin groups in which lifelong bonds and individual personalities play key

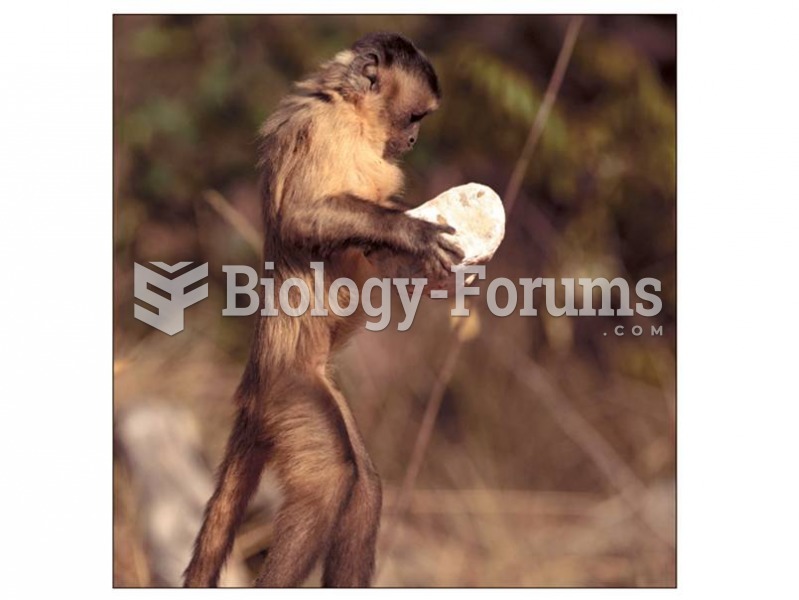

Capuchins use stones to crack open palm nuts in much the same way that chimpanzees in some populatio

Capuchins use stones to crack open palm nuts in much the same way that chimpanzees in some populatio