|

|

|

As of mid-2016, 18.2 million people were receiving advanced retroviral therapy (ART) worldwide. This represents between 43–50% of the 34–39.8 million people living with HIV.

Pope Sylvester II tried to introduce Arabic numbers into Europe between the years 999 and 1003, but their use did not catch on for a few more centuries, and Roman numerals continued to be the primary number system.

It is difficult to obtain enough calcium without consuming milk or other dairy foods.

Persons who overdose with cardiac glycosides have a better chance of overall survival if they can survive the first 24 hours after the overdose.

For pediatric patients, intravenous fluids are the most commonly cited products involved in medication errors that are reported to the USP.

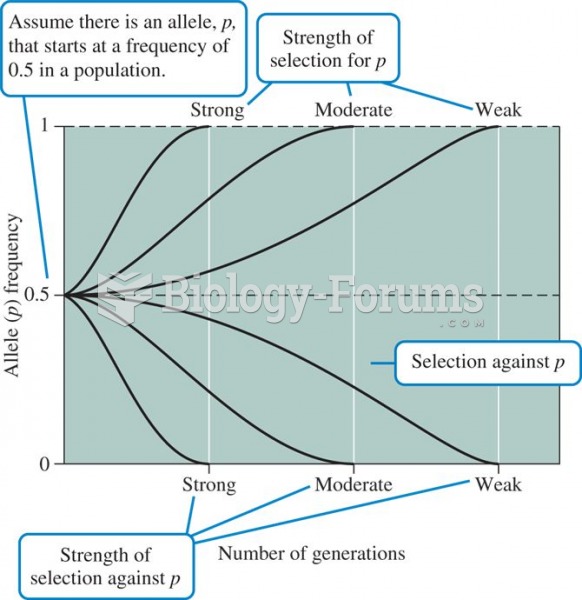

Variation in the rate of evolution as a function of the strength of selection, assuming genetic drif

Variation in the rate of evolution as a function of the strength of selection, assuming genetic drif

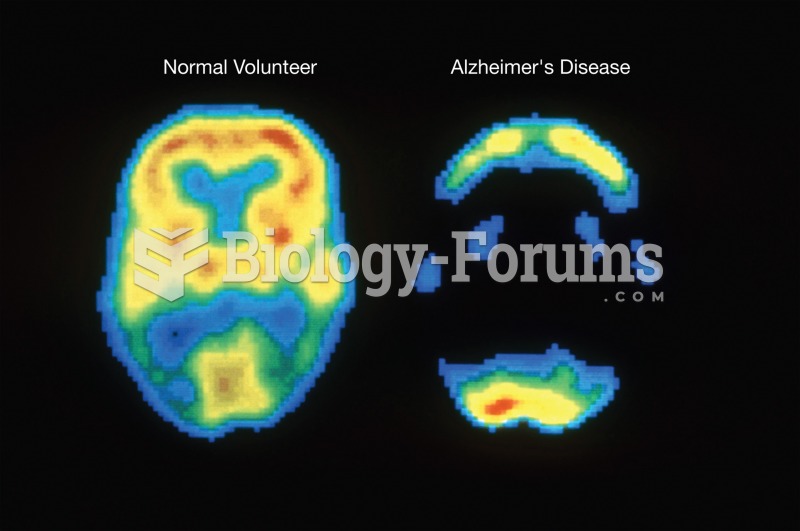

Positron emission tomography (PET) image showing the difference in the metabolic activity of the bra

Positron emission tomography (PET) image showing the difference in the metabolic activity of the bra