|

|

|

Medication errors are more common among seriously ill patients than with those with minor conditions.

Astigmatism is the most common vision problem. It may accompany nearsightedness or farsightedness. It is usually caused by an irregularly shaped cornea, but sometimes it is the result of an irregularly shaped lens. Either type can be corrected by eyeglasses, contact lenses, or refractive surgery.

Though methadone is often used to treat dependency on other opioids, the drug itself can be abused. Crushing or snorting methadone can achieve the opiate "rush" desired by addicts. Improper use such as these can lead to a dangerous dependency on methadone. This drug now accounts for nearly one-third of opioid-related deaths.

In most cases, kidneys can recover from almost complete loss of function, such as in acute kidney (renal) failure.

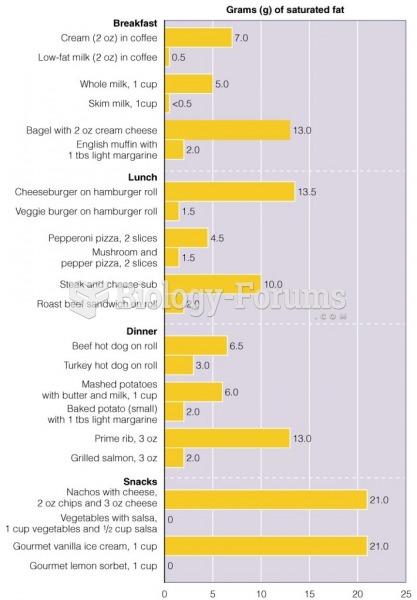

More than one-third of adult Americans are obese. Diseases that kill the largest number of people annually, such as heart disease, cancer, diabetes, stroke, and hypertension, can be attributed to diet.