Answer to Question 1

Note that since the two countries are large, neither country can be thought of any longer as facing a fixed external interest rate or a fixed level of foreign export demand. Consider only permanent shifts.

A permanent monetary expansion by Home, in the small country's case, would lead to currency depreciation and increase in output, interest rates also falling. When the Home economy is large, the same would happen, but now the rest of the world is affected too. Because Home is facing real currency depreciation, Foreign must be experiencing a real currency appreciation. This makes foreign goods relatively expensive and thus reduces its output. However, this increases Homes output, since Home's imports will rise. Thus, it is not clear what will happen to Foreign output. Note that Foreign output can rise only if the Foreign nominal interest rate rises too and can fall only if Foreign nominal interest rate falls. This is because the foreign market equilibrium is:

M /P = L(R , Y ). Because in this exercise M is not changing and P is sticky by assumption and thus fixed in the short run.

Consider now, a permanent expansionary fiscal policy in Home.

In the small country case, a permanent fiscal expansion would cause a real currency appreciation and a current account deterioration that would fully nullify any positive effect on aggregate demand. In effect, the expansionary impact of the Home fiscal ease would leak entirely abroad. This is because the counterpart of Home's lower current account balance must be higher current account balance abroad.

In the large country case, Foreign output still rises since Foreign's exports become relatively cheaper when Home's currency appreciates. In addition, now some of Foreign's increased spending increases Home exports, so Home's output actually increases along with the output of Foreign. Home's nominal interest rate must rise and Foreign's interest rate rises at the same time as well.

Answer to Question 2

C

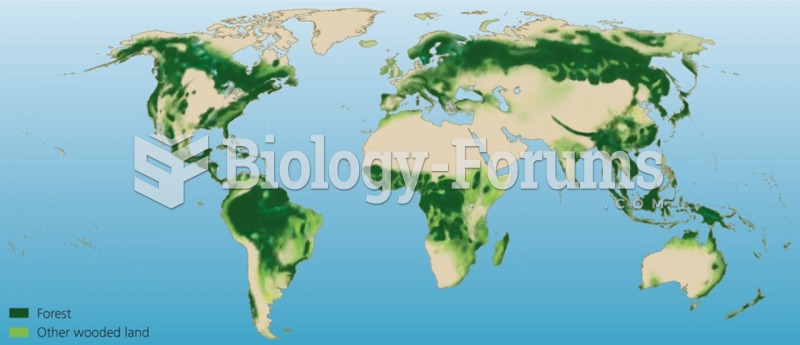

(a) Feeding by bear on salmon results in large allochthonous inputs of nutrients into (b) the forest

(a) Feeding by bear on salmon results in large allochthonous inputs of nutrients into (b) the forest

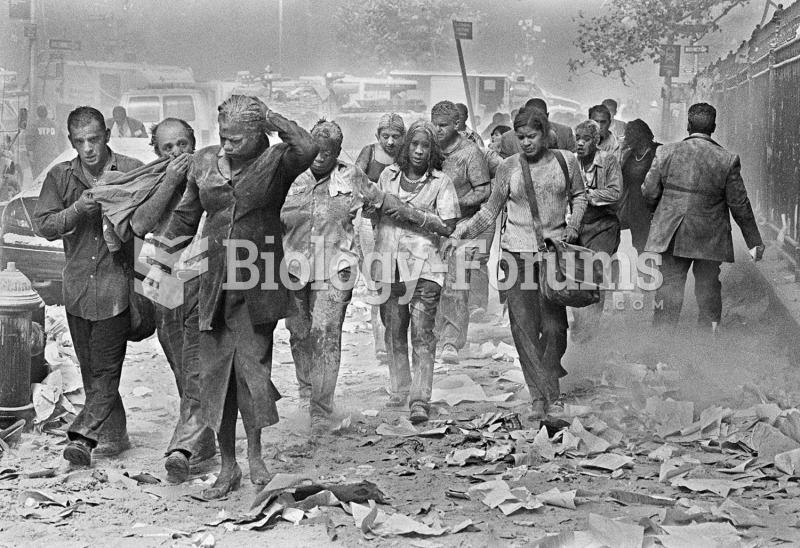

New Yorkers flee from the dust caused by the collapse of the twin towers of the World Trade Center f

New Yorkers flee from the dust caused by the collapse of the twin towers of the World Trade Center f