|

|

|

When taking monoamine oxidase inhibitors, people should avoid a variety of foods, which include alcoholic beverages, bean curd, broad (fava) bean pods, cheese, fish, ginseng, protein extracts, meat, sauerkraut, shrimp paste, soups, and yeast.

The Centers for Disease Control and Prevention (CDC) was originally known as the Communicable Disease Center, which was formed to fight malaria. It was originally headquartered in Atlanta, Georgia, since the Southern states faced the worst threat from malaria.

Cytomegalovirus affects nearly the same amount of newborns every year as Down syndrome.

Drug abusers experience the following scenario: The pleasure given by their drug (or drugs) of choice is so strong that it is difficult to eradicate even after years of staying away from the substances involved. Certain triggers may cause a drug abuser to relapse. Research shows that long-term drug abuse results in significant changes in brain function that persist long after an individual stops using drugs. It is most important to realize that the same is true of not just illegal substances but alcohol and tobacco as well.

Elderly adults are living longer, and causes of death are shifting. At the same time, autopsy rates are at or near their lowest in history.

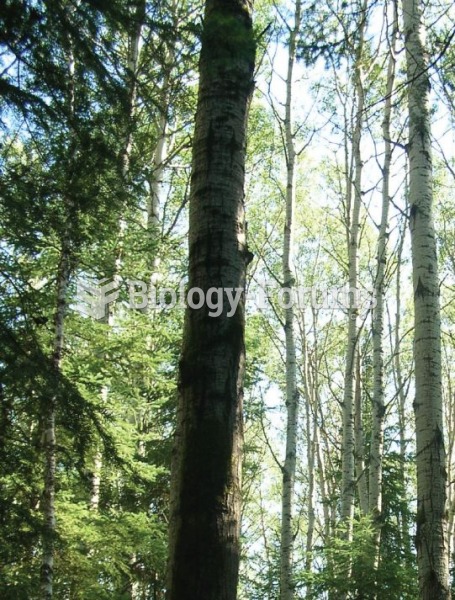

Changes in boreal forest composition along a chronosequence in Quebec. Dates refer to the year of th

Changes in boreal forest composition along a chronosequence in Quebec. Dates refer to the year of th

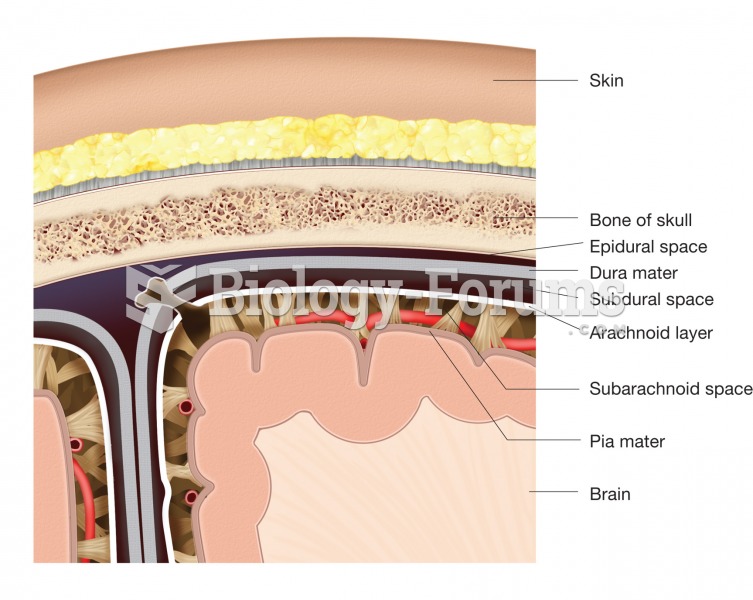

The meninges. This figure illustrates the location and structure of each layer of the meninges and t

The meninges. This figure illustrates the location and structure of each layer of the meninges and t