|

|

|

Famous people who died from poisoning or drug overdose include, Adolf Hitler, Socrates, Juan Ponce de Leon, Marilyn Monroe, Judy Garland, and John Belushi.

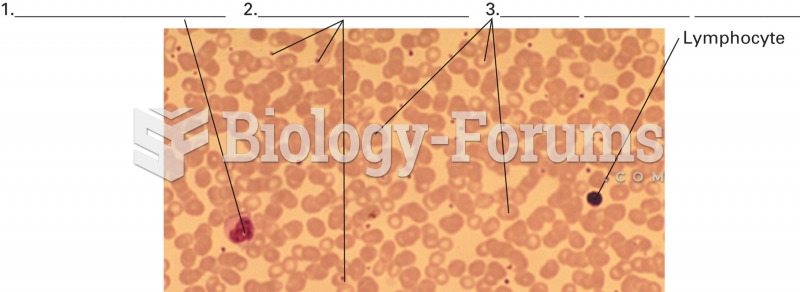

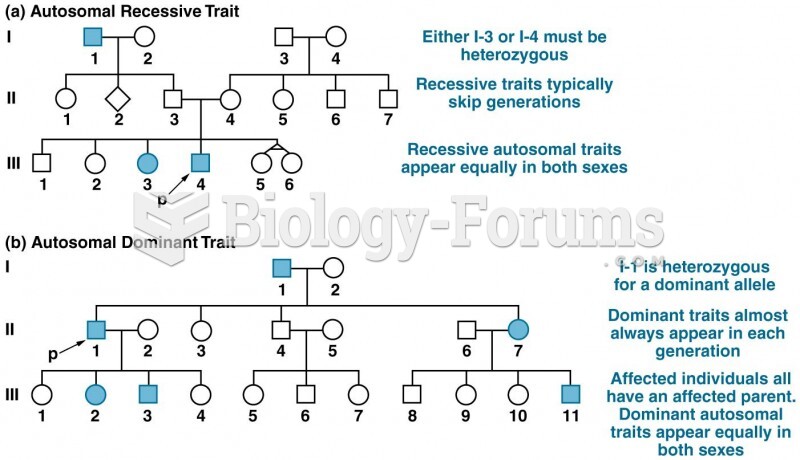

More than nineteen million Americans carry the factor V gene that causes blood clots, pulmonary embolism, and heart disease.

In the United States, congenital cytomegalovirus causes one child to become disabled almost every hour. CMV is the leading preventable viral cause of development disability in newborns. These disabilities include hearing or vision loss, and cerebral palsy.

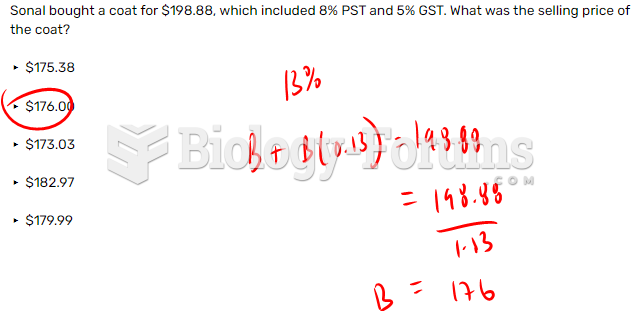

Recent studies have shown that the number of medication errors increases in relation to the number of orders that are verified per pharmacist, per work shift.

Intradermal injections are somewhat difficult to correctly administer because the skin layers are so thin that it is easy to accidentally punch through to the deeper subcutaneous layer.