|

|

|

Although not all of the following muscle groups are commonly used, intramuscular injections may be given into the abdominals, biceps, calves, deltoids, gluteals, laterals, pectorals, quadriceps, trapezoids, and triceps.

Serum cholesterol testing in adults is recommended every 1 to 5 years. People with diabetes and a family history of high cholesterol should be tested even more frequently.

Patients should never assume they are being given the appropriate drugs. They should make sure they know which drugs are being prescribed, and always double-check that the drugs received match the prescription.

The human body's pharmacokinetics are quite varied. Our hair holds onto drugs longer than our urine, blood, or saliva. For example, alcohol can be detected in the hair for up to 90 days after it was consumed. The same is true for marijuana, cocaine, ecstasy, heroin, methamphetamine, and nicotine.

There are more bacteria in your mouth than there are people in the world.

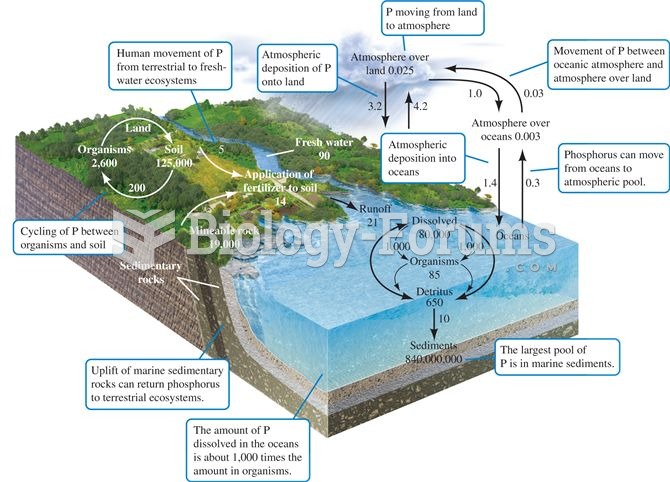

The phosphorus cycle. Numbers are 1012 g P or fluxes as 1012 g P per year (data from Schlesinger 199

The phosphorus cycle. Numbers are 1012 g P or fluxes as 1012 g P per year (data from Schlesinger 199

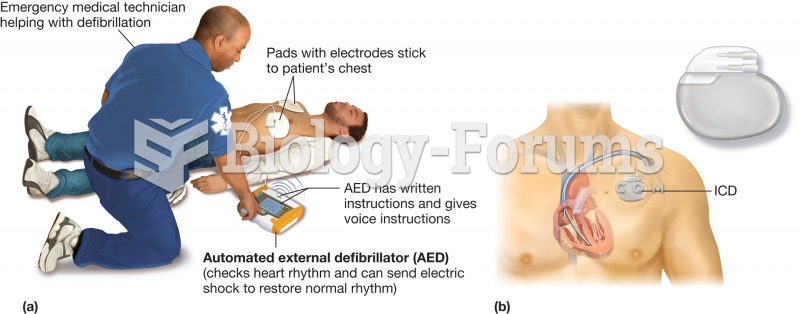

Defibrillator. Defibrillators are devices that supply a voltage charge to the heart in the hope of r

Defibrillator. Defibrillators are devices that supply a voltage charge to the heart in the hope of r