|

|

|

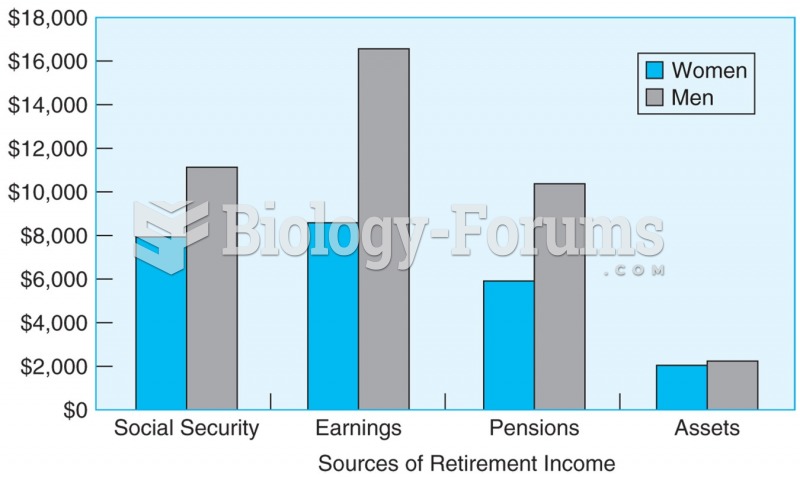

The senior population grows every year. Seniors older than 65 years of age now comprise more than 13% of the total population. However, women outlive men. In the 85-and-over age group, there are only 45 men to every 100 women.

About 600,000 particles of skin are shed every hour by each human. If you live to age 70 years, you have shed 105 pounds of dead skin.

Of the estimated 2 million heroin users in the United States, 600,000–800,000 are considered hardcore addicts. Heroin addiction is considered to be one of the hardest addictions to recover from.

It is believed that humans initially contracted crabs from gorillas about 3 million years ago from either sleeping in gorilla nests or eating the apes.

Elderly adults are living longer, and causes of death are shifting. At the same time, autopsy rates are at or near their lowest in history.