|

|

|

Studies show that systolic blood pressure can be significantly lowered by taking statins. In fact, the higher the patient's baseline blood pressure, the greater the effect of statins on his or her blood pressure.

The B-complex vitamins and vitamin C are not stored in the body and must be replaced each day.

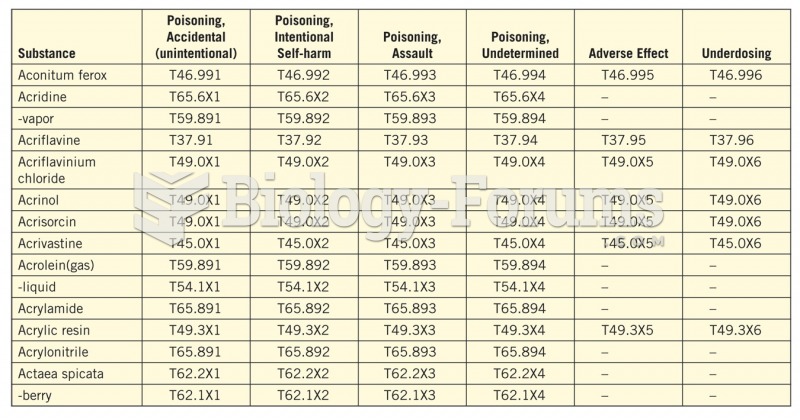

Always store hazardous household chemicals in their original containers out of reach of children. These include bleach, paint, strippers and products containing turpentine, garden chemicals, oven cleaners, fondue fuels, nail polish, and nail polish remover.

Inotropic therapy does not have a role in the treatment of most heart failure patients. These drugs can make patients feel and function better but usually do not lengthen the predicted length of their lives.

The effects of organophosphate poisoning are referred to by using the abbreviations “SLUD” or “SLUDGE,” It stands for: salivation, lacrimation, urination, defecation, GI upset, and emesis.